The Egyptian Tax Society Held Its Annual Conference in Alexandria

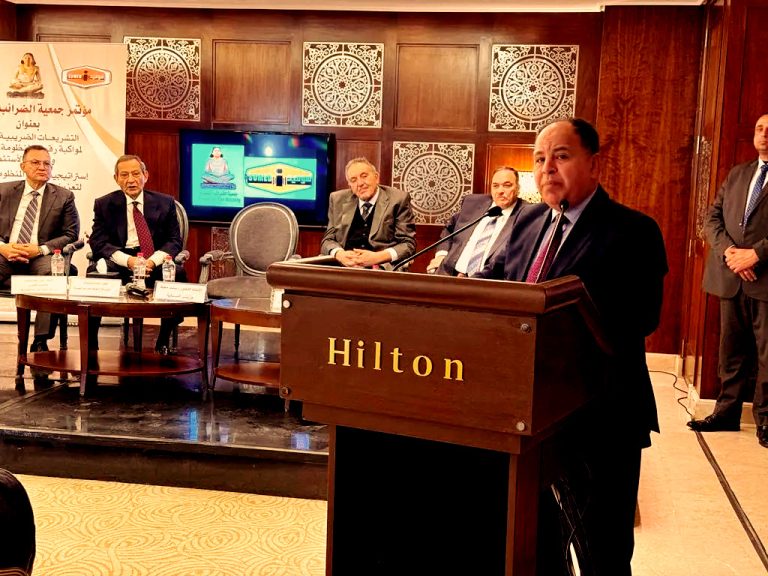

The Egyptian Tax Society held its annual conference at the Hilton Hotel in Alexandria in January 2024 under the title “Expected tax legislation to keep pace with the digitization of the tax system, encourage investment, and discuss the strategy for custom systems and application problems and their solutions to enhance governance and facilitate procedures.” This conference came under the patronage and presence of the Egyptian Minister of Finance, Dr. Mohamed Maait.

Who Attended the Annual Conference of the Egyptian Tax Society?

This conference was chaired by Dr. Ahmed Shawky, the Head of the Egyptian Tax Society, with the participation of Dr. Mohamed Maait, The Minister of Finance, Mrs. Rasha Abdel-Aal, the Acting Head of the Egyptian Tax Authority, Mr. Anwar Fawzi, the Head of the Real Estate Tax Authority, Mr. El-Shahat Al-Ghatouri, the Head of the Customs Authority, and Mr. Hisham Regal, the Advisor to the CEO of SUMED and the Head of the Financial Sector.

Topics Discussed in the Egyptian Tax Society’s Conference

Preparing a Social Protection Package

During the Egyptian Tax Society’s annual conference, A new topic was discussed, which is the government is preparing to introduce a social protection package that encompasses various improvements, including wage and pension adjustments and an increase in the tax exemption threshold, to ease the burden on the citizens. In addition, Egypt is committed to fostering public dialogue on the proposed state budget for the fiscal year 2024/2025 to determine its priorities for public expenditure in line with the new strategic objectives.

Moreover, the Ministry of Finance will present a structural reform of Egypt’s public finances to the Parliament before the end of the current fiscal year. And Egypt’s 2024/2025 tax policy strategy will be presented to the public for discussion next month.

Improving the Tax System is MOF and ETA’s Top Priority

The Egyptian Tax Society’s participants focused on the Ministry of Finance and the Egyptian Tax Authority collaboration to improve the tax systems and lay the foundations for more stable tax and customs policies that stimulate investment, which is consistent with financial policies that are more supportive of export activities and based on providing financial and investment incentives linked to real targets for sectors of strategic importance and global competitiveness.

In addition, the Ministry is working to set up systems that are more focused on automated tax and customs solutions and the use of some artificial intelligence applications to collect the public treasury dues in a way that enhances the process of determining the real status of the Egyptian economy by integrating informal activities and contributing to attracting more investment flows to the private sector, which is the primary driver of Egypt’s economic recovery and sustainable growth.

Tax Systems’ Role in Increasing Tax Revenues

The participants at the annual conference of the Egyptian Tax Society talked about the tax systems that have a significant impact in increasing the tax returns. For example, the tax returns increased by 26.9% during the fiscal year 2022/2023 without imposing additional burdens on investors. They also contributed to a 43.6% rise in revenues from real estate transactions and a 67% increase in revenue from the gold sector.

In addition, automating the stock market sector’s system for unlisted stocks led to an improvement in total payments in Egyptian and foreign currencies. The electronic systems also helped speed up tax examination procedures to complete them annually. It is worth noting that the SPGS, an electronic invoice governance platform, was launched to link it with the e-invoice system, thus contributing to the optimal exploitation of state resources.

Exempting Investors from Some Types of Taxes

On the sidelines of the Egyptian Tax Society’s annual conference, it was discussed that the ETA is close to completing a new draft law for income taxes and will be presented to the public for discussion during February 2024 for approval before taking the necessary measures to refer it to the Council of Ministers and then the House of Representatives.

In addition, the necessary legal measures have been taken to exempt strategic industrial projects from some types of taxes for a period of 5 years. The Ministry of Finance also began to introduce a “clearing” system between investors’ dues and their tax burdens to benefit government agencies while setting a time limit of 45 days to ensure a quick VAT refund.

Moreover, there is an “investment incentive” of 33% to 55% of the tax due on the profit earned from green hydrogen projects and strategic industries, in addition to dropping the unpaid VAT on machinery and equipment imported abroad for use in industrial production immediately after the start of production. The goods or services exported abroad or imported to economic zone projects are subjected to a “zero” tax rate. It is worth noting that the implementation of Investment Law No. 72 of 2017 is renewed, which includes deducting a percentage of the value of investment costs amounting to 50% of the taxable base for projects in zones (A) and (B).

Enhancing Egypt's Customs Capabilities

During the Egyptian Tax Society’s annual conference, it was discussed that the Ministry of Finance is committed to enhancing customs capabilities by establishing logistical centers, electronically integrating all ports via a unified platform, and implementing the Advanced Cargo Information (ACI) system, which enables electronic pre-registration of shipments. These measures are designed to streamline the customs clearance process and ensure that all importers adhere to global quality standards for goods and merchandise to protect local markets from poor products.

In addition, 50 customs applications have been automated and unified with the incoming and outgoing systems on the “Nafza” platform, and the process of valuing the goods is carried out from any logistics center without being restricted by the goods’ location. These automated systems helped increase customs revenues by 129% during the last fiscal year, exceeding the targeted rates.

Moreover, the Ministry has worked to accelerate the pace of customs release of strategic goods, medicines, petroleum materials, fuel, and production requirements for priority sectors in a way that contributes to the rotation of the wheel of production, supporting the national industry, securing the strategic stock, and increasing the volume of supply of basic commodities in local markets.

And now you have known everything about the Egyptian Tax Society’s annual conference and the topics discussed. For more information about the Egyptian Tax Society’s conference, click here or here.

AHG Provides High-Quality Tax Services

Our team at AHG Chartered Accountants will provide a wide range of tax services tailored to your business needs. We will develop a comprehensive tax strategy that minimizes liabilities and maximizes your tax benefits. Not only that, but we’ll keep you informed of any changes in tax laws, identify potential risks, and provide proactive advice, enabling you to make informed financial decisions that benefit your business. For more information about our tax services, click here.