AML Compliance in UAE

Anti-money laundering

What is Money Laundering ( AML Compliance ) ?

Money laundering is defined as any financial or banking transaction aimed at concealing or changing the source of illegally obtained funds, by passing it through the financial and banking system in order to make it appear as originating from legitimate sources, and then re-pumping and investing it illegally

A Safe Working Environment for the Business Sector

The Ministry of Economy, as the supervisory authority, is entrusted with the supervision of the ‘Designated Non-financial Businesses and Professions’ (DNFBPs) sector at the state level and commercial free zones in order to combat money laundering and financing of terrorism. It is committed to developing a strong regulatory framework and providing a safe environment for organisations, companies, and DNFBPs to work according to international best practices. It also contributes towards raising the competitiveness of the state’s economic, investment and financial environment, building an attractive business and investment climate within various sectors, and creating a balanced, flexible and sustainable future economic model. The priorities include providing all possible forms of knowledge, guidance and training support for Designated Non-financial Businesses and Professions, and raising their level of awareness to be able to fulfil their commitments, in partnership with various economic sectors. The main objective of the efforts of the Ministry of Economy at the international level is to raise the level of compliance with international requirements and maintain the top position and positive reputation of the national economy in global markets as well as with all countries and international partner organisations.

The benefits of Anti-Money Laundering (AML) measures include:

- Risk Mitigation: AML practices help prevent financial institutions and businesses from being unwittingly involved in money laundering or terrorist financing activities.

- Legal Compliance: Implementing AML procedures ensures compliance with local and international regulations, reducing legal risks and potential penalties.

- Enhanced Reputation: Companies with robust AML programs are seen as trustworthy and responsible, enhancing their reputation among clients, investors, and partners.

- Customer Trust: AML measures protect customers’ assets and personal information, fostering trust and loyalty.

- Financial Stability: By preventing illicit financial flows, AML contributes to overall economic stability.

Importance of AML Compliance in UAE for Real Estate Sector

The UAE has established itself as a global economic powerhouse and a leading hub for trade, tourism, and real estate investment. However, with increased economic opportunities come increased risks of money laundering and terrorist financing. In response, the UAE government has implemented stringent Anti-Money Laundering (AML) regulations to protect the integrity of the financial system and align with international standards. The real estate sector, in particular, needs to comply with these AML laws due to its potential vulnerability to money laundering activities.

As per the National Anti-Money Laundering and Counter-Terrorism Financing Committee, real estate brokers, agents, and developers are classified as ‘Designated Non-Financial Businesses and Professions (DNFBPs)’ under the UAE’s AML regime. This puts additional responsibilities on real estate firms to implement compliance measures and conduct due diligence on clients to verify their identities and assess risks. Failing to comply with ‘Know Your Customer’ (KYC) norms and reporting suspicious transactions can lead to serious fines and criminal liability.

What is AML Compliance?

AML compliance refers to the measures that businesses take to prevent money laundering and terrorist financing. These measures include:

- Identifying and verifying the identity of customers

- Analysing customer transactions for suspicious activity

- Reporting suspicious transactions to the authorities

Why is AML Compliance Important in the UAE ?

The UAE real estate sector is vulnerable to money laundering and terrorist financing for a number of reasons, including:

- The high value of real estate transactions makes them attractive to criminals.

- The real estate sector is often opaque and unregulated, making it difficult to track transactions.

- The real estate sector is a major source of investment in the UAE, making it a target for criminals who want to legitimize their illegal activities.

AML Compliance Requirements for Real Estate Agents and Brokers in the UAE

The AML regulations that apply to real estate agents and brokers in the UAE are included in Federal Decree-Law No. 20 of 2018, which is based on AML and CFT laws.

These regulations require real estate agents and brokers to:

- Identify and ensure the reliability of the identity of their customers

- Retain customer identification records for five years

- Reporting the authorities of any illegal transactions

- Implement internal AML controls

- Detecting any money laundering risks

- Maintaining all the records of every transaction

Non-compliance to AML regulations

If a firm fails to comply with AML regulations in the UAE, then the consequences can be severe. Real estate agents and brokers who fail to comply may be fined, imprisoned, or both. They may also have had their licenses revoked. In addition, real estate agents and brokers who fail to comply with AML regulations may be held liable for any losses that are caused by money laundering or terrorist financing.

AML compliance is essential for real estate agents and brokers in the UAE. By complying with AML regulations, they can help prevent their businesses from being used to launder money or finance terrorism. There are a number of resources available to help real estate agents and brokers comply with AML regulations like AHG. AHG helps in maintaining the AML regulations as well as guiding according to the rules. By taking steps to comply with AML regulations, real estate agents and brokers can help to make the UAE a safer place for everyone.

Combatting money laundering

The Decree-Law defines a perpetrator of a money-laundering offence as any person who is aware that the money was derived from a felony or misdemeanour, and intentionally continues to transfer, conceal, acquire, help somebody to acquire or possess such money.

Anti-money laundering laws, AML Compliance

Federal Decree No. 20 of 2018 (PDF, 500 KB) on Anti-Money Laundering and Countering the Financing of Terrorism was issued to develop the legislative and legal structure of the nation to ensure compliance with international standards on anti-money laundering and countering the financing of terrorism. The law aims to:

- combat money-laundering practices

- establish a legal framework that supports the authorities concerned with anti-money laundering and crimes related to money-laundering

- counter the financing of terrorist operations and suspicious organisations.

The Decree-Law defines a perpetrator of a money-laundering offence as any person who is aware that the money was derived from a crime, and intentionally commits one of the following acts:

- transferring or transporting proceeds of crime with intent to conceal or disguise its illicit origin

- concealing or disguising the true nature, origin, location, way of disposition, movement or rights related to any proceeds or the ownership thereof

- acquiring, possessing or using such proceeds

- assisting the perpetrator of the predicate offence to escape punishment.

The Law stipulates that money laundering is independent of the predicate crime and that the punishment of the person who has committed a predicate offence shall not protect him or her from being penalised for money laundering.

The Anti-Money Laundering and Combatting the Financing of Terrorism Supervision Department (AMLD) serves three key objectives:

- Examining Licensed Financial Institutions (LFIs),

- Ensuring adherence to the UAE’s AML/CFT legal and regulatory framework, and

- Identifying relevant threats, vulnerabilities and emerging risks concerning the UAE’s financial sector.

Compliance and Examination:

Devises the annual AML/CFT risk-based supervisory plan, conducts supervisory examinations and issues corrective actions to LFIs. It also recommends sanctions and disciplinary measures in addressing cases of non-adherence by LFIs.

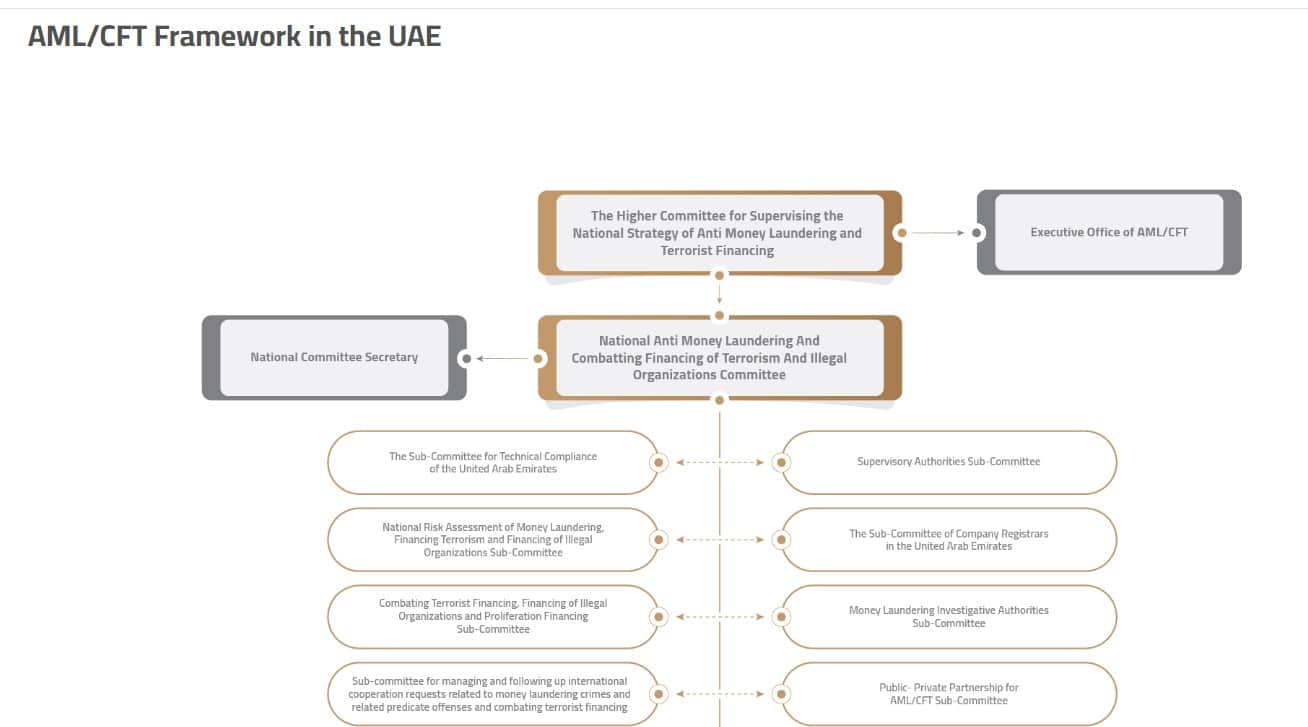

The UAE’s National AML/CFT Committee (NAMLCFTC), chaired by His Excellency the Governor of the CBUAE, revised the UAE’s National Strategy in line with the risks identified in the MER and the UAE’s National Risk Assessment. This strategy change is supported by an enhanced National Action Plan that outlines a detailed series of initiatives and actions with multiple domestic stakeholders and authorities to implement the MER’s recommendations. The CBUAE also contributed significantly to the National Action Plan. The CBUAE has defined compliance with the MER’s recommendations as a key strategic objective and focus area for 2020-2021.

Moreover, we proudly use our 30 years of experience in this field, and cutting edge technologies preform auditing and accounting services to guarantee time efficiency and quality assurance. AHG exclusively offer our clients the flexibility to access their financial information and auditing reports online.