IFRS 16 leases UAE 2024

IFRS 16 Leases has now been successfully adopted by companies reporting under IFRS® Standards. It is the new normal for lease accounting around the world. IFRS 16 had a significant impact on the financial statements of lessees with ‘big-ticket’ leases, from retailers to banks to media companies. Although lessors found much that was familiar in IFRS 16, they faced new guidance on a number of aspects, from separating lease and non-lease components, to more radical accounting changes for more complex arrangements such as sale-and-leaseback transactions and sub-leases.

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments.

What is a lease?

A lease is a contract (i.e., an agreement between two or more parties that creates enforceable rights and obligations), or part of a contract, that conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

Implications of IFRS 16

Lease accounting drew more puzzlement and uncertainty as the new IFRS 16 replaced the existing accounting standard IAS 17 in the year 2019. Though most of the entities have now completed the transition as required by the standard, accountants across the industries often face many challenges in applying IFRS 16 while analyzing and recording new leasing arrangements. In this section we will discuss Implications of IFRS 16.

Major changes brought forward by IFRS 16 in lease accounting

IFRS 16 aims for bringing more transparency and uniformity in the realm of lease accounting. With respect to the companies having large assets on lease, the impact of this change will be substantial in their financial statements, as the material lease liabilities cannot still remain as off balance sheet items.

IFRS 16 has removed the segregation of leases between finance leases and operating leases which was prevailing as per the previous standard. Now as per the new standard more emphasis is being given to the right of use of the assets covered in lease contracts, with a view in bringing most of those assets as part of the statements of financial position of the lessees. Also as and when leased assets are getting recorded, their respective payment obligations are also to be recognized as liabilities in the balance sheet across the lease term. Additionally, depreciation and interest elements are to be included in the income statement over the lease period based on the lease term and value of the asset. From the perspective of lessors, there are not many changes due to the implementation of IFRS 16.

The benefits of IFRS 16 include:

- Increased visibility of companies’ lease commitments and better reflection of economic reality.

- Easier comparison of companies that lease their assets with companies that borrow money to buy their assets, creating a more level playing field.

- Better informed investment decisions by investors.

- More balanced lease-versus-buy decisions by management.

- Improved capital allocation, which should be beneficial for economic growth.

Accounting for a lease under IFRS 16

Anyone familiar with finance leases under the previous lease accounting standard will understand that the required accounting is far more intensive. This is because every lease requires:

- A net present value calculation is required for every lease, which represents the liability associated with the lease

- The calculation of a leased asset which is based on the liability amount

- Any changes to the future payments of the lease require an update to these calculations

Where to start - the lease liability

A lease agreement can be very long and convoluted. From a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability:

- The commencement of the payments, aka the commencement date of the lease

- The payments required over the lease life, aka the lease term

- The end date of the lease payments also referred to as the expiry of the lease

Right of use asset

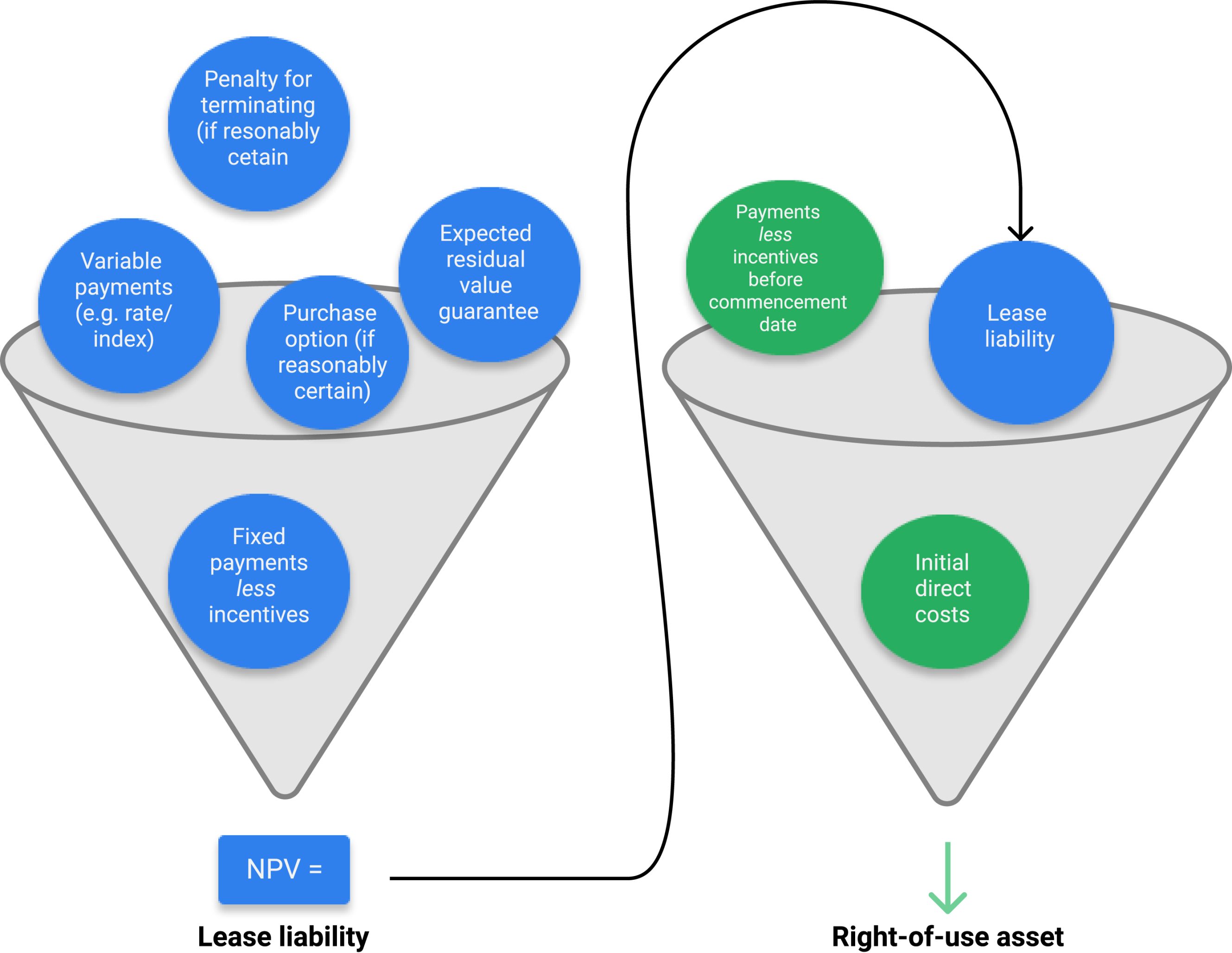

The majority of the value attributed to the right of use asset amount is derived from the lease liability value. When initially recognizing the value of the right of use asset, the other inputs that impact the value are:

- The make good provision: any costs that will be incurred restoring the leased asset to a necessary condition

- Any direct costs incurred during the initiation of the lease

- Any lease payments made at or before the commencement date, less any lease incentives received

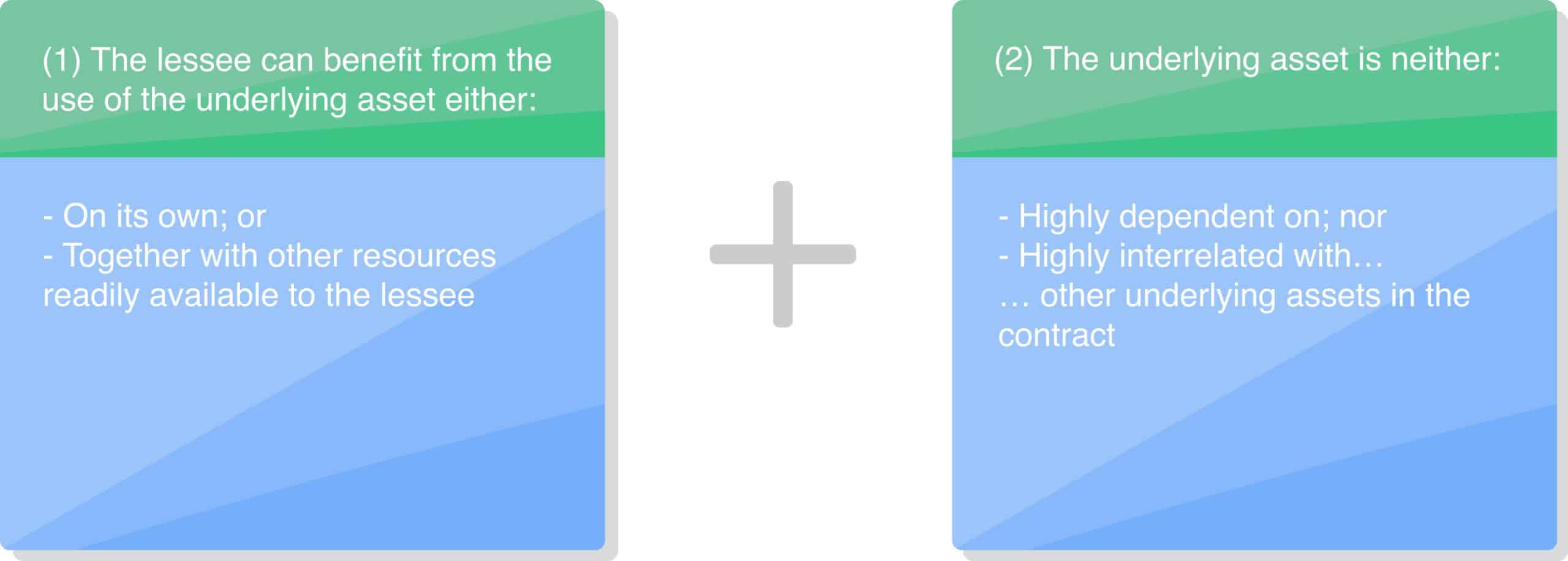

How to identify a separate lease component

Both of the above criteria must be met to be considered a separate lease component.

AHG offers monthly, quarterly, semi-annual and annual financial statements (statement of financial position, statement of comprehensive income, and cash flow statement & owners’ equity statement). Our reports can be arranged for both in Arabic & English. As well, AHG exclusively allows its clients to obtain their reports online for time saving and archiving proposes

Your operations will focus on business growth, since we secure accurate and reliable reports on timely basis. Subsequently, this will accelerate your decision making process.