Accounting outsourcing in UAE

Accounting outsourcing is when an organization delegates its accounting and financial functions to an external third-party service provider.

Accounting Outsourcing

Accounting plays a crucial role in running every business successfully. Being a commercial hub, UAE hosts a large number of businesses and they all need to maintain the book of accounts and track financial transactions. Accounting outsourcing in UAE is the best practice adopted to keep the books of accounts accurate and error-free. AHG offers accounting outsourcing services in UAE to help you to identify the financial indicators and performance promptly, enabling you to make the right decisions in your business at the right time. By choosing AHG as your bookkeeping partner in UAE, you avail professional accounting services delivered with the most confidentiality and security in the shortest turnaround.

What is bookkeeping ?

Bookkeeping includes the regular recording of the company’s financial transactions.

Companies can track all the information on their books to make key operational, investment, and financing decisions.

Accountants are individuals who manage all of a company’s financial statements.

Without accountants, companies would not be aware of their current financial situation, as well as the transactions that occur within the company.

Accurate bookkeeping is also essential for external users, including investors, financial institutions, or government

People or organizations need access to reliable information to make better investments or lending decisions.

Simply put, business entities rely on accurate and reliable bookkeeping for internal and external users.

Outsource Accounting Services In UAE

UAE has been becoming a business hub for the investors for the last so many years because of its diverse nature and leniency by the government. Along with the expansion of the business, the necessity of maintaining proper books of account has become a legal obligation for every company in the UAE.

Accounting is the measurement, processing, and recording of financial information of a company. The accounting field is developing fast by adapting to the numerous needs of a business. It is the backbone of every business. Whether you own a start-up or an established business, while planning to outsource accounting services in UAE, you need to find an experienced accounting firm which provides outstanding services at the most competitive price.

When it comes to accounting outsourcing in UAE, AHG is the ultimate word. AHG offers Accounting Outsourcing Services in UAE to the business world with exact prediction and conviction.

The proper accounting and documentation safeguard the interest of every business and legal threat.

The followings are some of the different types of accounting a business should manage according to their nature:

- Financial accounting :

It is the procedure of creating a financial statement for external use. It shows the past performance and the current status of an organization, which give credibility of the business in front of the customers and suppliers.

- Management accounting or MIS Reporting:

Here, the information is used for the internal purpose to enable effective control within the organization and the fulfilment of the strategic objectives of the concern. It helps with the proper decision making by the management.

- Tax Accounting:

This accounting is managed by the tax laws of a state to estimate the tax liability of a company and to avoid any fine or penalty because of any wrong Tax Filing. Proper filing of input tax and output tax will provide transparency with FTA requirements.

- Project Accounting :

This system is used especially by the construction firms to track the financial progress of a project through the frequent financial report and will help to analyze the profitability of the project. Budgeting is the key tool used in this reporting.

Why Outsourced Accounting Service?

Outsourced Accounting is a service that gives a complete accounting department experience for a business whether it is established one or SMEs. The accounting department controls the day-to-day transaction coding, accounts receivable, accounts payable, payroll, management of financial reporting and many other services as per the demand of the company. Outsourcing accounting services in UAE helps you avail high-level of accuracy in financial accounting and reporting, identify loopholes and frauds, reconciliation of account statements, save processing time, professional assistance, avoid tax penalties, maintain up-to-date accounting status, and more.

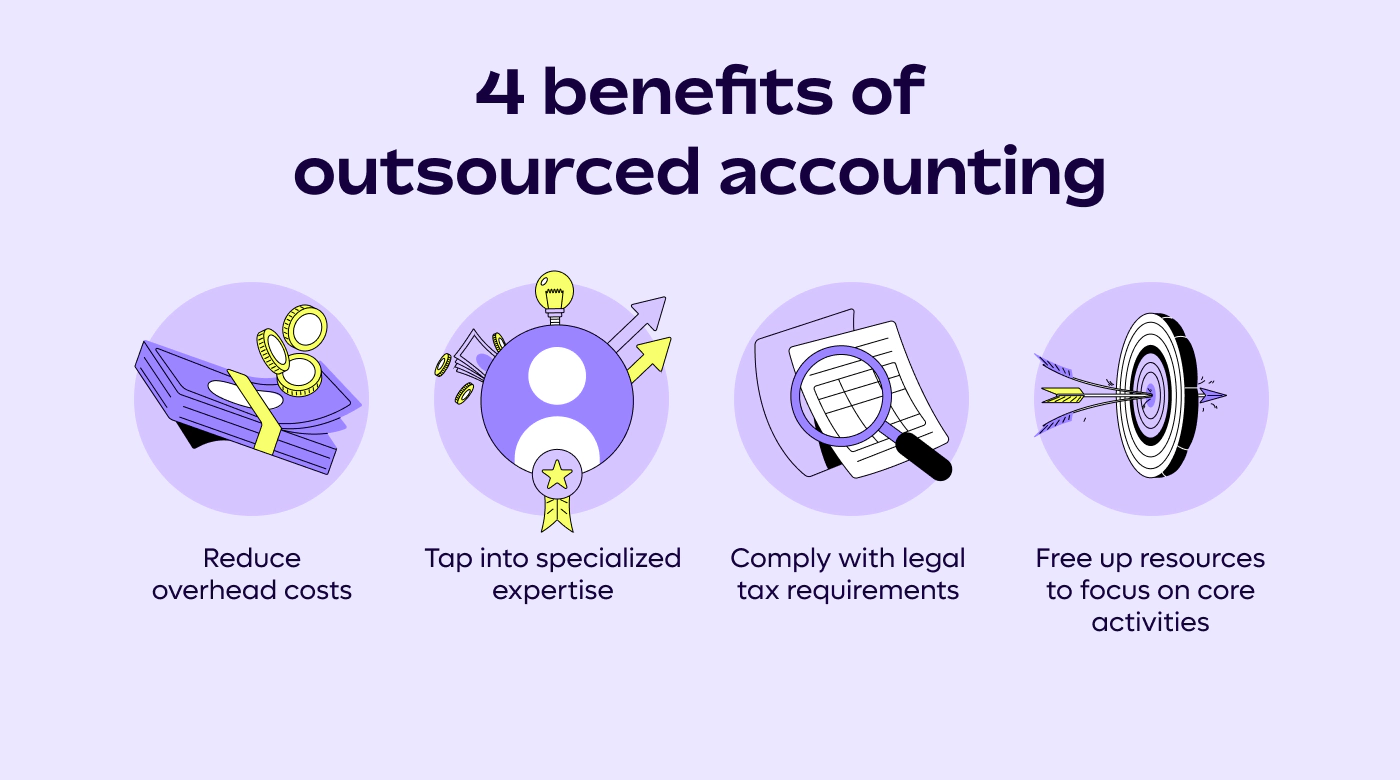

What are the benefits of outsourced accounting?

If you’re unsure of the benefits of outsourcing your accounting, consider the following:

It reduces overhead costs

As certified professionals, accountants don’t come cheap. The amount of work you have available may not justify hiring one in-house, even on a part-time basis.

When you outsource your accounting responsibilities, you can significantly reduce what you would otherwise be paying. For any business this is a plus, but for budget-conscious growth startups, this can be a game-changer, allowing you to focus funds and resources elsewhere.

It grants access to specialized expertise

When you outsource, you’re tapping into decades of experience and expertise across multiple facets of accounting. This ensures you’re getting the best support and advice on a range of financial matters, from tax planning to financial forecasting and budgeting.

It ensures you comply with local legal requirements

If you’re hiring across borders, you’ll have to recruit in-house accountants in all the countries you’re onboarding in. This can be costly and complex, especially if you don’t have legal entities in those countries.

When you outsource, you can leverage the expertise and experience of firms who are already established in those markets. This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified.

It frees up resources

If you’re a small business that manages its own books, you could be spending your time and resources elsewhere. After all, there are only so many hours in a day.

Outsourcing your accounting allows you and your team to focus less on numbers and legislation, and more on more strategic initiatives, like growing your business, running and improving your day-to-day operations, and building products.

Which types of outsourced accounting services are available?

When outsourcing, you don’t necessarily need to delegate everything. As a result, it’s helpful to understand what you might want to outsource, and what you might want to keep in-house.

Here are some of the standard services you can outsource:

Accounts receivable and accounts payable management

Accounts receivable (AR) and accounts payable (AP) are essential accounting functions for any business. They ensure the timely collection of payments from your customers for products or services sold (AR), and management of the money you owe to vendors (AP).

AR tasks you can outsource include:

- Issuing invoices to customers

- Tracking and recording payments received

- Conducting credit checks on new customers

AP tasks you can outsource include:

- Reviewing and approving supplier invoices

- Reconciling supplier statements with company records

- Negotiating payment terms with suppliers

Outsourcing these tasks to professionals allows you to better manage your cash flow, maintain healthy relationships with your suppliers, and more accurately gauge profitability.

Payroll management

Payroll management is all about making sure your employees are paid accurately and on time for their work. In administrative terms It involves calculating wages, withholding taxes and other deductions, and issuing payslips.

You can outsource payroll management to an accounting firm, but it’s often easier, faster, and more cost-effective to use a global HR platform like Remote — especially if you have team members in different locations.

By adopting this approach for payroll, you can ensure that:

- All your team members get paid the right amount in the right time frame

- All your data is streamlined and manageable in one place, as opposed to spread across multiple tools and sources

- You’re fully compliant with all employment and payroll tax laws in all the countries and individual states you have people in

- You’re kept up to date — and able to comply with — any changes to those laws

Tax preparation

Almost all companies must pay taxes on their income, regardless of where they are headquartered. But preparing taxes and complying with regulations can be tricky, especially if your business has a complex corporate structure. Many businesses outsource this task to a certified tax professional.

You must also manage the relevant tax obligations for your employees and (in some cases) independent contractors. If you have team members working abroad, this can be confusing. Again, Remote can help ensure that you are withholding (and contributing) the right amounts of tax for your employees, regardless of where they are based. We can also help ensure that you are filing the right tax paperwork, including contractor paperwork.

As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited.

Internal audit

As a business, internal audits are an important tool for mitigating risk. They enable you to understand:

- If your operations are compliant with all relevant tax laws and regulations

- How effective your internal controls are

- If there any instances of potential fraud (or any other issues that could affect your company’s financial management)

Many companies outsource this task to experienced auditors, who can independently assess your company’s financial processes and even advise on ways to improve.

Financial planning and analysis

To make the best possible financial decisions, it’s important to fully understand your company’s financial position and analyze potential outcomes.

Many accounting firms specialize in financial planning and analysis, and can:

- Provide in-depth analysis reports to determine your company’s financial health

- Help you prepare budgets for upcoming financial periods

- Analyze financial performance against key performance indicators (KPIs)

- Create detailed planning models that inform financial strategy and decision-making

How to outsource your accounting

If you’d like to outsource some or all of your accounting obligations, here’s how to get started.

1. Determine which accounting functions to outsource

First, analyze your accounting operations and determine which functions you’d like to outsource. Consider factors such as time spent on certain tasks, the level of expertise required, and the costs of performing these tasks in-house.

The goal here is to identify:

- What can be handled more efficiently by an an external provider

- If it will free up your internal team to focus on other important tasks

2. Research service providers

Once you’ve established what you want to outsource, the next next step is to identify who you’re going to outsource it to.

As a general rule, look for a provider that can work as an extension of your company and that can scale alongside yours. They should have:

- Relevant experience in your industry

- Expertise in the areas you need help with

- A proven track record of delivering results

- Strong communication skills

- Security measures for data protection

Directly engage with potential providers and request a meeting to discuss your needs. If possible, obtain references from past or existing clients too. Compare your options and choose a provider that meets your requirements and, of course, your budget.

3. Establish a service-level agreement

When working with any service provider, it’s important to establish service-level agreements (SLAs). These lay out the specifics of the services provided and keep both parties on the same page.

In your SLA, ensure you clarify:

- What services (and level of service) is being provided

- What the delivery timelines are

- What metrics are being used to measure performance

- What the pricing structure for their services is

You should also specify what happens if the provider fails to meet any of these expectations. This could be anything from a partial refund for a late delivery, to termination of the contract in more extreme cases.

Establishing a SLA should, in practice, be fairly straightforward. However, if there is anything in the provider’s agreement that you’re uncomfortable with, don’t hesitate to challenge it or move on to another provider.

4. Ensure your data is protected

Once you’ve signed an agreement, your service provider will need access to your data. Set up restricted user accounts, and only provide access to the systems and data that are needed for the provider to perform their tasks.

Also, take all relevant steps to protect sensitive financial and employee information during data transfers. This will help minimize the potential for data misuse, keep your data secure, and ensure you’re compliant with any relevant data protection laws in your region.

5. Maintain regular communication

Maintaining regular communication with your provider is key to building a strong, collaborative relationship and addressing potential misunderstandings before they escalate. Set up check-ins with your provider every once in a while to discuss the partnership and convey expectations. This will help keep both of you aligned.

6. Continuously evaluate the partnership

As alluded to in the previous step, outsourcing isn’t a “set it and forget it” solution. As your business changes or grows, continuously assess whether the agreement is continuing to meet your business needs.

If the relationship is no longer providing value, or expectations are starting to fall short, you may want to take corrective action. This might include revising the SLA, or potentially scrapping it altogether.

AHG Accounting Outsourcing

The UAE Commercial Company Law 2015 and the UAE VAT Law make it mandatory for a company to preserve proper books of account for a minimum of five years. For a well-established company or for SMEs, it may be a difficult task to accomplish the accounting activities within the company when they compete with others or comply with the laws of the land.

To keep pace with the growing economy of the country and to comply with the legal requirements and to compete with other businesses, it is sometimes difficult for a company to manage the accounting activities of their businesses within the company, especially for SMEs. Hence, a good number of businesses now prefer accounting outsourcing services in UAE as the best option, and AHG tops the list of accounting outsourcing companies in UAE with skill and advanced technology, highly qualified and result-oriented reporting with the competitive process.

AHG offers monthly, quarterly, semi-annual and annual financial statements (statement of financial position, statement of comprehensive income, and cash flow statement & owners’ equity statement). Our reports can be arranged for both in Arabic & English. As well, AHG exclusively allows its clients to obtain their reports online for time saving and archiving proposes

Your operations will focus on business growth, since we secure accurate and reliable reports on timely basis. Subsequently, this will accelerate your decision-making process.