A new player

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to think and act like humans. It involves the development of algorithms and computer systems that can perform tasks that would normally require human intelligence.

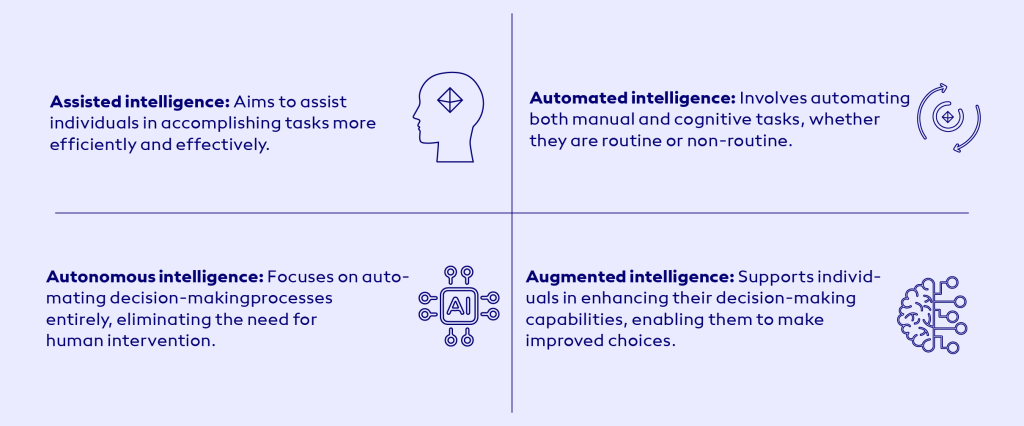

AI encompasses various technologies such as robots, chatbots, and machine learning. It operates through four distinct methods:

- Automated intelligence: Involves automating both manual and cognitive tasks, whether they are routine or non-routine.

- Assisted intelligence: Aims to assist individuals in accomplishing tasks more efficiently and effectively.

- Augmented intelligence: Supports individuals in enhancing their decision-making capabilities, enabling them to make improved choices.

- Autonomous intelligence: Focuses on automating decision-making processes entirely, eliminating the need for human intervention.

Table of Contents

AI in Business

Artificial Intelligence-supported decision-making is a game-changer, allowing us to think better and make decisions faster with a long-term perspective. By harnessing the power of Artificial Intelligence, we can analyze vast amounts of data that would be overwhelming for humans alone. This enables us to optimize pricing by considering historical data, competitor behaviour, and customer satisfaction.

The advancement of “AI at the edge” further accelerates decision-making speed. Overall, “AI empowers us to incorporate extensive information, make informed choices, and achieve better outcomes.”

What Business Owner see?

Artificial Intelligence is set to have an enormous impact, amounting to a staggering $15.7 trillion, on the global economy by 2030. The findings of our comprehensive analysis for this report emphasize the transformative nature of Artificial Intelligence and the immense value it holds. This figure surpasses the combined current economic output of China and India. Out of the total, $6.6 trillion is expected to stem from heightened productivity, while $9.1 trillion will arise from the effects on consumption. The potential for economic growth and opportunities brought by Artificial Intelligence is truly remarkable

The Big transformation.

It has the potential to revolutionize many aspects of our lives, from finance and transportation to entertainment and education. Artificial Intelligence is an exciting and rapidly evolving field with many opportunities for innovation and advancement.

Artificial Intelligence is revolutionizing the finance industry. Artificial Intelligence helps the financial industry streamline and optimize processes ranging from credit decisions to quantitative trading and financial risk management.

Artificial Intelligence has many applications in finance, including chatbot assistants, fraud detection, and task automation. Most banks (80%) are highly aware of the potential benefits presented by AI2. AI can help banks streamline tedious processes and vastly improve the customer experience by offering 24/7 access to their accounts and financial advice services2.

The market value of AI in finance was estimated to be $9.45 billion in 2021 and is expected to grow 16.5 percent by 2030

PWC

Impact of Artificial Intelligence on audit profession

Artificial Intelligence is revolutionizing the audit profession by fundamentally changing how auditors carry out their tasks, leading to improved efficiency, precision, and valuable insights. Here are several ways in which AI is influencing the audit profession:

1. Automation of manual tasks: Automation of manual tasks in audit refers to the use of technology to automate repetitive and labour-intensive tasks in the audit process. This can be achieved through the use of various technologies, including Robotic Process Automation (RPA), which can automate repetitive and manual tasks, freeing up time for auditors to focus on higher-value activities1. Other technologies that can be used to automate tasks in auditing include digitizing working papers and their management using software such as CASEWARE, using audit software (e.g. IDEA and ACL) to perform specific audit testing, and using statistics software (e.g., STATA and R) to run regressions1

2. Improved data analysis: Improved data analysis in audit refers to the use of advanced data analytics techniques to enhance the audit process. Data analytics can help auditors gain deeper insights into the data they are analyzing, allowing them to identify anomalies, trends, and correlations that may not be apparent through traditional audit methods1. By using data analysis techniques and methods, audit teams can start analyzing client data early in the audit process, enabling the teams to tailor the audit approach and deliver a higher-quality audit with more relevant audit evidence.

3. Increased accuracy: AI algorithms are designed to be highly accurate and consistent, reducing the risk of errors in the audit process.

4. Improved fraud detection: Data analytics can help auditors identify patterns and anomalies in large datasets that may indicate fraudulent activity. For example, auditors can use data analytics to identify unusual transactions or changes in financial data that may be indicative of fraud. Another way to improve fraud detection in audit is through the use of a “three lines of defence” model, which involves collaboration across the corporate governance and reporting ecosystem to help protect companies from material fraud2.

5. Better decision-making: AI can provide auditors with more data and insights, enabling them to make better-informed decisions and recommendations

Threats:

A person engaged in a specific occupation undertakes a multitude of diverse tasks, and while some of these tasks can be automated, others cannot. Therefore, it would be inaccurate to claim that AI will replace numerous jobs entirely. However, Artificial Intelligence has the potential to assume control over many of the individual tasks that constitute current job roles.

Automating predictable physical tasks proves to be relatively straightforward. Machines excel at executing repetitive work on a large scale, utilizing mechanical power as a substitute for human physical effort. Furthermore, they can supplant humans in mundane administrative and repetitive tasks.

The adoption of Artificial Intelligence in the finance and accounting industry brings new unique risks and challenges that need to be addressed to ensure financial stability. These risks include performance risks, security risks, control risks, societal risks, economic risks, and ethical risks1

A new Dune

There are concerns that the adoption of AI could lead to job losses in certain industries. According to a report by investment bank Goldman Sachs, AI could replace the equivalent of 300 million full-time jobs. However, it is also predicted that AI will create 97 million new jobs by 2025. The impact of Artificial Intelligence on employment will vary across different sectors. For example, 46% of tasks in administrative and 44% in legal professions could be automated, but only 6% in construction and 4% in maintenance.

The true value of AI lies in its ability to accomplish unprecedented tasks, going beyond mere automation or speeding up existing capabilities. This means that certain strategic opportunities may not align with past experiences or intuitive judgments. As a business leader, embracing Artificial Intelligence may require taking a leap of faith. However, the reward is the potential to become significantly more capable and relevant than your business could ever be without harnessing the infinite