FTA VAT Registration

The Federal Tax Authority (FTA) was established under Federal Law by Decree No. 13 of 2016. The authority takes charge of managing and collecting federal taxes and related fines, as well as distributing tax-generated revenues and applying the tax-related procedures in the UAE.

What is Tax?

Tax is the means by which governments raise revenue to pay for public services. Government revenues from taxation are generally used to pay for amenities such as public hospitals, schools and universities, as well as defence, infrastructure and other important aspects of daily life.

A direct tax

Which is collected by government from the person on whom it is imposed (e.g., income tax, corporate tax).

An indirect tax

which is collected for government by an intermediary (e.g. a retail store) from the person that ultimately pays the tax (e.g., VAT, Sales Tax).

What is Value Added Tax (VAT) / FTA VAT Registration?

Value Added Tax (or VAT) is an indirect tax. Occasionally, it might be referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and services that are bought and sold.

VAT is one of the most common types of consumption tax found around the world. Over 150 countries have implemented VAT (or its equivalent, Goods and Services Tax), including all 29 European Union (EU) members, Canada, New Zealand, Australia, Singapore and Malaysia.

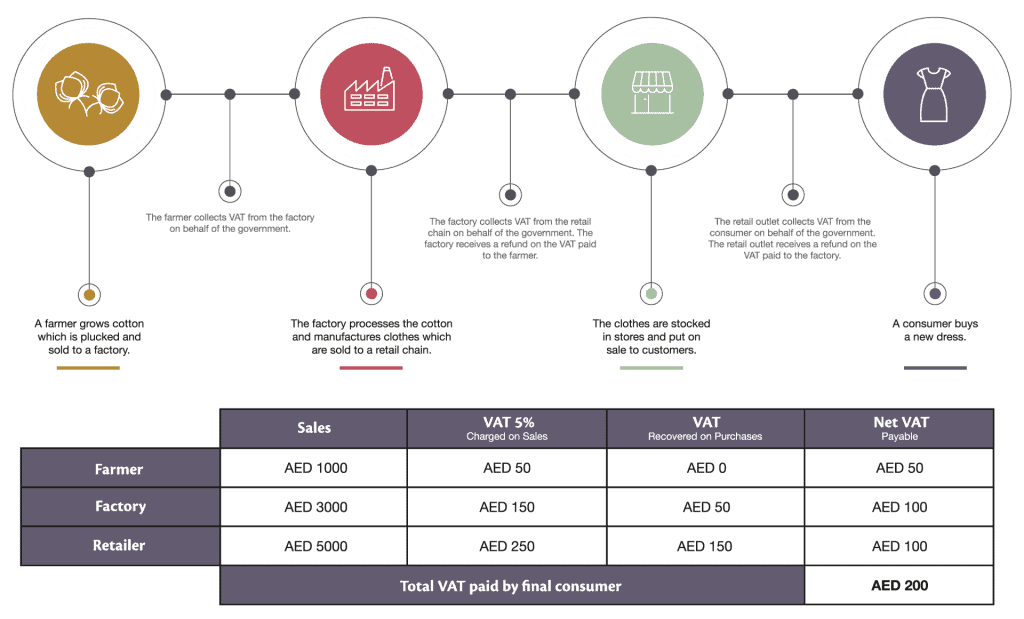

VAT is charged at each step of the “supply chain”. Ultimate consumers generally bear the VAT cost while businesses collect and account for the tax, in a way acting as a tax collector on behalf of the government.

A business pays the government the tax that it collects from the customers while it may also receive a refund from the government on tax that it has paid to its suppliers. The net result is that tax receipts to the government reflect the “value add” throughout the supply chain. Below is a simple, illustrative example explaining how VAT works (based on a VAT rate of 5%)

VAT Registration Requirements in UAE

A business must register for VAT if the taxable supplies and imports exceed the mandatory VAT registration threshold of AED 375,000. Furthermore, a business may choose to register for voluntary VAT registration where the total value of its taxable supplies and imports (or taxable expenses) is more than the voluntary VAT registration threshold of AED 187,500.

Documents required for VAT registration in UAE

To register for VAT in UAE, businesses must complete the required documents. The process for VAT registration and fee submission will be done online. The following documents are required for VAT registration in UAE.

- Copy of Trade License (must not be expired).

- Passport copy of the owner/partners who own the license (must not be expired).

- Copy of Emirates ID of the owner/partners who owns the license (must not be expired).

- Memorandum of Association (MOA) – (not required for sole establishments).

- Contact details of the company (complete address and P.O Box).

- Concerned person’s contact details (Mobile Number and E-mail).

- Bank Details (Account Number, Account Name, Bank Name, Branch Name & IBAN).

- Turnover Declaration for the last 12 months (must be signed, stamped and printed on company letterhead).

- Business is doing export and import

- Business is dealing with any custom department? If yes, then attach the VAT Registration Letter.

How is VAT Certificate in UAE collected?

VAT-registered businesses collect the amount on behalf of the government; consumers bear the VAT in the form of a 5 per cent increase in the cost of taxable goods and services they purchase in the UAE.

UAE imposes VAT on tax-registered businesses at a rate of 5 per cent on a taxable supply of goods or services at each step of the supply chain.

Tourists in the UAE also pay VAT at the point of sale.

AHG as registered Tax agents in Dubai provides creative tax consulting services to a broad range of individuals and businesses. Our strong technical understanding of the tax laws is backed by a solid understanding of your business dynamics, with more than 30+ years of Practical Experiences, Dealing thousands of times with Tax Inspectors & our Multilingual team we can give you the best tax advice