ICV certificate in UAE

The National In-Country Value (ICV) Program aims to boost economic performance and support local industries by redirecting more procurement spending into the national economy.It aims to stimulate and attract foreign investments, diversify the economy, create valuable job opportunities in the private sector and contribute to the growth of the national GDP.

The ICV Programme is implemented under the supervision of Ministry of Industry and Advanced Technology (MoIAT).

The programme aims to achieve the following goals:

- strategic localisation of supply chain

- development of new local industries and services

- stimulating and attracting foreign investments

- diversifying the economy

- creating valuable job opportunities in the private sector

- contributing to the growth of the national GDP

- enhancing spending on research and development (R&D) and advanced technology

- increasing the private sector’s contribution to national GDP.

ICV certificate

The ICV certificate is issued to certified companies after evaluating their contribution to the local economy. Certified companies gain advantages during the awarding of tenders and contracts based on their ICV score.

How to Get ICV Certificate in UAE?

AHG Chartered Accountants is one of the leading Dubai audit firms providing ICV certification consulting services since the beginning. We have extensive and detailed knowledge of the applicable guidelines using which you can improve your ICV score. The process becomes reasonably easy when our consultants work with your team in the entire certification process.

Obtaining an ICV Certificate

The application process is fairly easy. However, there are a few guidelines that you should be aware of.

Guidelines

- The first thing to note is that ICV Certification can only be handed out by Empaneled ICV certifying bodies in UAE.

- When a supplier applies for the certification, they shall require a separate ICV Certificate for every business license that they possess. Every business license will be recognized as a separate legal entity. If a business has multiple branches operating under one license, then a single, combined certificate will be issued for that company.

- ICV Certification Templates must be completed by the applicant.

- Figures entered in the template must all be taken from a company’s latest IFRS compliant audited financial statements. These financial statements should not be older than 2 years. Newly established companies (less than 10 months old) who do not have audited financial statements can take figures from their Management Accounts instead. Bear in mind that the management accounts should not be older than 9 months. If they are, they will need to be audited by an approved audit firm before they can be used.

- After the Certificate has been received, it will remain valid for 14 months (from the date of issuance of audited financial statements). Companies can apply for certification again before this time period elapses. They may use the same financial statements as well. However, receiving an updated certificate will not negate the validity of the previously obtained certificate.

- Once a company appoints an Empaneled Certifying Body to verify them for certification, the company will not be able to switch to a new certifying body for the duration of their certification (unless they have an adequate reason).

- The submission made by a company shall take all costs and revenues of the company during its financial year.

- All figures in the ICV Template must be in AED. Exceptions can only be made if specified.

- If a company is not able to present consumption details (listed by invoice and vendor), purchases made by the company during that year can be taken into account instead.

- Any assumptions and calculations made in the ICV Template must follow instructions provided in the guideline.

- Every figure presented by the supplier must be backed with relevant documentation so that all provided data can be examined thoroughly. At any time during the verification process, a designated representative of the participating entities can ask for a quality review of every ICV Certificate Template being scrutinized by the Certifying Body. The Certifying body and supplier will have to share any required information with the representative, whenever it is asked for.

- Negligence or tampering in a company’s submission will lead to penalties being awarded to the company in question. These penalties can include a ban preventing them from doing business with ADNOC.

Once you are certified, you can begin submitting bids to participating entities. The exact edge that you receive in the bidding process will be determined by your ICV score.

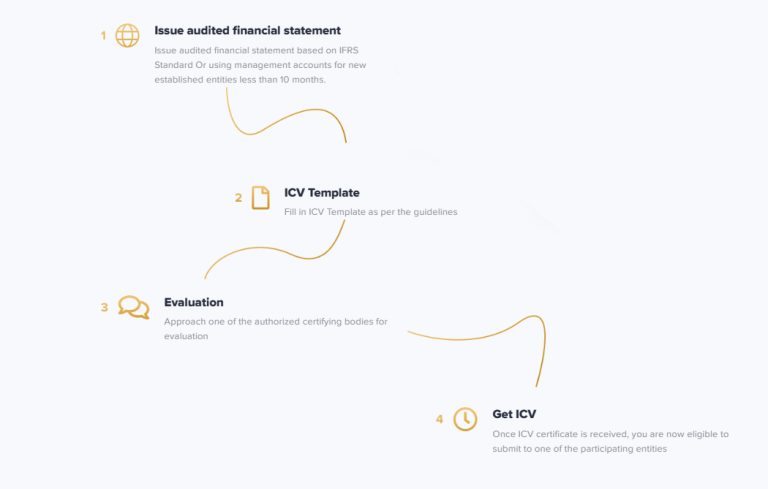

How to get ICV Certificate?

1-Issue audited financial statement

Issue audited financial statement based on IFRS Standard Or using management accounts for new established entities less than 10 months

2-ICV Template

Fill in ICV Template as per the guidelines

3-Evaluation

Approach one of the authorized certifying bodies for evaluation

4-Get ICV

Once ICV certificate is received, you are now eligible to submit to one of the participating entities

why your company needs ICV certificate for business?

The ICV certificate also helps companies and grants them the opportunity for the first right of refusal in the tender process. While companies who do not possess the ICV certificate will still be allowed to participate in Adnoc Group tenders, their ICV score will be considered as zero in the bid evaluation and they will be at a disadvantage compared to those with a higher ICV score.

ICV certificate is based entirely on the audited financial statements of the company as per International Financial Reporting Standards (IFRS). Financial statements should not be older than two years from the certification year. And for companies with multiple entities, each license within a group is considered an independent legal entity even if ownership is the same.

Benefits Of ICV Certification in The UAE

After the ICV started, the ADNOC ICV program supported around 1,500 Emirati’s search for jobs in the private sector and accounted for over Dh44 billion in the economy of the UAE. The ICV Certification has been permit to more than 3,000 businesses in the UAE. The ICV program verifies several adjustable, added assets, employment of Emiratis, financing from emigres, revenue made outside of the UAE, and a height in assets. This program has given rise to a new business segment that requires sourcing from the UAE.

- The ICV Certification increases the private sector’s contribution, boosts the GDP’s expansion, and localizes important supply chain components.

- The ICV Certificate permits people to establish short-chain businesses or medium-sized enterprises to grow and boost development as the store chain is simply confined.

- The ICV Certification holders can advantage of the agreement from the federal management and partner companies.

- In the procurement of goods, ADNOC actively encourages local manufacturing units to participate directly in tender bids. Consequently, in the evaluation of all purchasing tenders, preference will be given to local manufacturing bidders or their Regional Brokers over brokers of manufactories located abroad. This strategic approach not only contributes to boosting the suppliers’ ICV score but also yields personal benefits for them, ultimately contributing to the overall economic upliftment of the nation.

In AHG Chartered Accountants, we exclusively offer high quality accountant services by professional experts,

dedicated to fulfill the different clients’ needs in Egypt, UAE, and all over the world.

Through a wide range of accountant services, especially designed to turn any challenges and obstacles

into opportunities and successes, we guarantee a safe growth and development for your business, in a world full of risks, which needs a trusted

partner to guide you along the way.