Input Tax UAE

Input Tax Recovery Under VAT in UAE

The possibilities of input VAT recovery is implied within the name of the tax itself which is “Value-Added Tax”. The ultimate tax impact to the companies is supposed to limit to the extent of their part of value addition involved in their respective stage of the supply chain and thereby companies can recover the VAT on expenses incurred to make their supplies taxable. A key component of VAT in UAE is the provision for recovery of tax paid on inputs. Also, it is important to note that before claiming for any input VAT recovery, the eligibility of those expenses is to be validated first

What is an Input Tax?

An input tax is a levy paid by a business on acquired goods and services. When a business then taxes its customers, this is considered an output tax. The business pays the federal revenue authority the difference between the output tax and input tax if the amount is positive, or it can apply for a tax refund if the amount is negative. The business cannot apply for a refund of input tax if the purchase does not have a business purpose.

These could be:

- Goods you purchase in the UK

- Goods you purchase outside the UK

- Goods you bring into Northern Ireland from a taxable person in an EU member state

- Services you purchase but receive outside the UK

- Development, research and overhead costs

How to reclaim the input VAT on expenses if that has been missed to be claimed in the first two respective tax periods?

There can be situations where you miss to include an input VAT recovery in the VAT return of the first two tax periods in which the conditions are met for those expenses. In those cases, a reclaim of such missed input VAT can be made only through a voluntary disclosure procedure in any subsequent period to amend the reported amounts of either of those two tax periods.

Example: During the month of October 2020, the company noted that it has missed to include an input VAT recovery relating to an invoice which was received and paid in June 2020. The company submits VAT return on a monthly basis. Ideally as stipulated by the VAT rules, the company was supposed to include the claim of this input VAT in their VAT return either for the month of June 2020 or July 2020. Now the only option possible to reclaim that missed input VAT in October 2020 is to do a voluntary disclosure to amend the amounts of VAT return submitted for June 2020 or July 2020.

How input VAT works

Here’s a simplified example of how input VAT works in practice:

Imagine you own a bakery, and you buy flour and sugar from a supplier. Let’s say the total cost of these ingredients is €100, and the VAT rate is 20%. This means you will pay €20 in VAT on this purchase. This $20 is your input VAT.

Now, you use the flour and sugar to make cakes that you sell in your bakery. Let’s say you sell a cake for €20, including a 20% VAT of €4. When you collect this €4 from your customer, it becomes your output VAT.

How to calculate Input TAX

Calculating input VAT ( Input Tax ) is a straightforward process:

- Gather invoices and receipts: Collect all invoices and receipts for purchases made by your business that include VAT. These could be expenses like office supplies, raw materials, equipment, and services.

- Verify VAT information: Ensure that the invoices and receipts contain the correct VAT information, including the VAT rate and VAT amount. Mistakes in these documents can lead to errors in your calculations.

- Add up input VAT: Sum up the VAT amounts from all your invoices and receipts. This total represents the input VAT you have paid.

Reasons for an Input Tax deduction being rejected

A tax authority may reject an input VAT deduction for several reasons. For example, if the invoices or receipts lack necessary information, such as the VAT identification number of the supplier, a clear description of goods or services, or proper evidence of the transaction’s legitimacy, the deduction could be denied.

The tax authority may also reject a VAT deduction if they suspect fraudulent activity or non-compliance. This could include situations where the claimed deduction exceeds the taxpayer’s actual VAT liability, or if there are discrepancies in the reported VAT amounts compared to the records of the supplier.

Input VAT: The tax you pay

It’s important to have a good grasp of input VAT:

- Cash flow management: Properly accounting for input VAT allows businesses to manage their cash flow more effectively. By reclaiming the VAT paid on expenses, businesses can reduce their VAT liability, freeing up funds for other purposes like investment, expansion, or day-to-day operations.

- Cost control: Understanding input VAT helps businesses accurately assess the true cost of their inputs. This, in turn, enables better cost control and pricing strategies, as businesses can factor in the tax implications of their expenses.

- Compliance and avoiding penalties: Failing to account for input VAT correctly can lead to compliance issues and potential penalties. Businesses that claim too much input VAT may be subject to audits and fines, while those that understate their input VAT may miss out on legitimate deductions.

- Competitive advantage: Competing in today’s marketplace requires efficiency. Businesses that can effectively manage their input VAT can often offer more competitive prices, potentially attracting more customers.

What happens if input VAT is greater than output VAT?

If your input VAT is higher than your output VAT, it means that the company is currently in a VAT credit position with the ability to receive reimbursement for the credit.

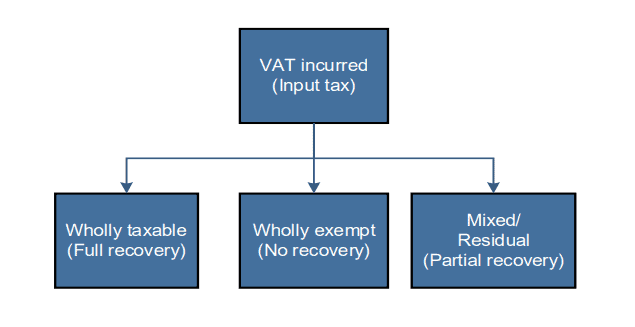

Input tax apportionment per tax period

Input tax which is incurred in respect of goods or services which are used partly for making supplies that allow for VAT recovery and partly for other purposes for which VAT is not recoverable is referred to as “residual input tax”. Residual input tax must be apportioned between those activities. Recovery will be restricted to the portion relating to supplies that allow for VAT recovery.

Benefits of Input Tax Credit (ITC) include:

- Avoiding double taxation

- Eliminating the cascading effects of taxes

- Reducing the indirect tax burden on consumers

- Increasing the overall tax base resulting in more revenue for the government

Since AHG ’s an Approved Tax Agency in the FTA of UAE we can provide all VAT Related Services which range from the Implementation and Tax Impact Tests, Registration, Filing VAT Returns, Filing Voluntary Disclosures, Filing, Refunds, Representation in front of the Federal Tax Authority (FTA) of UAE in case of Tax Audits in addition to the VAT Consultancy Services and full Tax Agency Services.