Creating an investment climate in Egypt is one of the most important gains witnessed by the economic reform period since the start of implementation until now, due to the importance of this climate to attract investments and encourage business owners to inject new investments, raise employment rates, and provide job opportunities, and thus achieve the targeted growth rates, and the legislative amendments came at the forefront of efforts to create the appropriate investment environment, and open the door for the Egyptian and foreign private sector to contribute to increasing employment rates, growth, and providing job opportunities for young people.

Table of Contents

Laws of incorporation

Investment Law No. 72 of 2017 and its Executive Regulations

The Investment Law No. 72 of 2017 establishes the fundamentals for the new laws of incorporation fostering and encouraging investment activity in Egypt while considering development objectives. The law ensures that investors are treated fairly regardless of the size or nationality of the project, and it works to foster entrepreneurship, develop small and medium-sized businesses, ensure fair competition, implement corporate governance, as well as simplify investment procedures to lower associated risks.

The one-stop shop system is activated for the first time following the successful implementation of the administrative reform that enables representatives of various government agencies represented in the Investment Services Center to choose the documents and other materials that will be used in an investment transaction. Investors can apply for services and pay investment-related fees online, in addition to setting timetables for investment services, and government authorities are required to respond to investors during that period. It makes it easier to conduct business and make investments in Egypt.

On October 28, 2017, the Prime Minister’s Decree No. 2310 of 2017 issued the Executive Regulations of the Investment Law No. 72 of 2017, which consist of 133 articles divided into 5 chapters: general provisions, investor-related facilities and incentives, the Investors Service Center, investment, technological and free zones, and the organization of the investment environment.

Items of the Executive Regulations of the New Investment Law

According to laws of incorporation

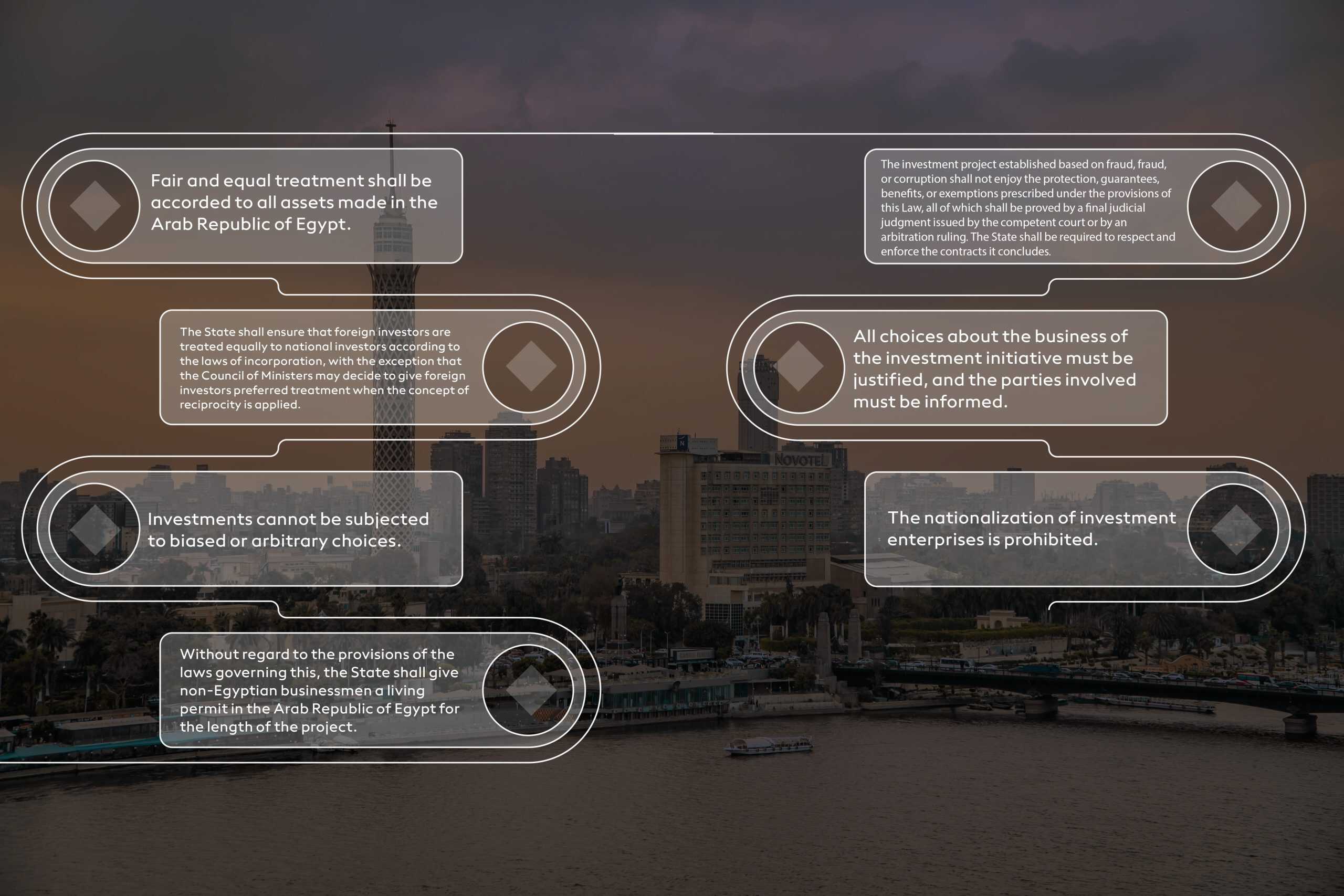

The investment law of Egypt offers according to the laws of incorporation for businesses several incentives and forbids nationalization, the seizure and freezing of assets, and government meddling in the setting of a company’s product price. It also protects investors, defines several new incentives alongside the use of existing incentives, offers new avenues for resolving investment disputes, and implements procedural reforms that reduce red tape and make business transactions simpler.

The most important advantages of the Investment Law No. 72 of 2017

Access to finance: By fostering financial inclusion, a solid basis for the expansion and advancement of the Business sector has been established.

Ease of beginning a business: Investors have a variety of choices available to speed up the registration process and license clearance process based on the laws of incorporation . The most recent administrative change speeds up the investment process and decreases the amount of time needed to obtain an investment license, buy property, and use utility services.

Activating the one-stop-shop shop system at the General Authority for Investment and Free Zones: The laws of incorporation new law effectively implements the one-stop-shop shop system through decentralization, as well as by allowing several representatives of the pertinent authorities to be present in the Investors Service Center and sign investor documents.

Accreditation services across the country for the first time, third parties from the private sector will support the government and will examine investors’ operations and documents for licensing approvals through these independent delegation services.

Investor protection: according to the laws of incorporation Mechanisms have been put in place to prevent the nationalization of the investor’s property, the implementation of arbitrary or discriminatory decisions, or the abuse of authority. Projects may not be nationalized, taken into custody, or frozen except by a court order. The law also activates the guarantees for investor protection through several committees, such as the Ministerial Committee for the Resolution of Investment Matters.

Increasing Competitiveness: Egypt’s investment law and The laws of incorporation are a revolutionary step towards eliminating red tape and reducing bureaucracy because it increases competitiveness, eliminates monopolies, promotes governance and transparency, and most importantly, establishes clear timetables for approval processes.

Governance: The rules of good governance & The laws of incorporation of the General Authority for Investment and Free Zones (GAFI) were clarified, and the roles and powers of the Supreme Council for Investment (SCIC), which is responsible for setting investment policies and strategies by Egypt’s social and economic objectives, were defined.

Additional, Private, And Governmental Benefits to the laws of incorporation

General Incentives:

All projects subject to the provisions of The laws of incorporation Law shall enjoy it, except projects established under the free zone system, which are:

- Contracts of incorporation of companies and establishments, credit facilities, and mortgages related to their business shall be exempted from stamp tax, notarization, and registration fees for a period of five years from the date of their registration in the commercial register.

- Land registration contracts necessary for the establishment of companies and establishments shall be exempted from the aforementioned tax and fees.

- The provisions of Article (4) of the Law Regulating Customs Exemptions promulgated by Law No. 186 of 1986 concerning the collection of customs tax in a unified category of (2%) two percent of the value shall apply to companies and establishments subject to the provisions of this Law, on all imported machinery, equipment and devices necessary for their establishment, and this unified category shall also apply to all machines, equipment, and devices required for their establishment or completion imported by companies and establishments working in public utility projects.

- Without prejudice to the provisions of temporary release stipulated in the Customs Law promulgated by Law No. 66 of 1963, investment projects of an industrial nature subject to the provisions of this Law shall have the right to import molds, molds, and other production requirements of a similar nature without customs duties, to be used for a temporary period in the manufacture of their products and their re-export abroad, and the release and return abroad shall be under the arrival documents, provided that the entry and re-shipment documents shall be recorded in records prepared for this purpose at the Authority, in coordination with Ministry of Finance.

Special Incentives:

- all according to The laws of incorporation Investment projects established after the entry into force of The laws of incorporation by the Investment Map shall be granted an investment incentive deducted from the net taxable profits, as follows:

- Percentage (50%) deducted from the investment costs of Sector (A):

- It includes the geographical areas most in need of development according to the investment map and based on data and statistics issued by the Central Agency for Public Mobilization and Statistics, and according to the distribution of investment activities in them as adopted by the executive regulations of this law.

- (30%) deducted from the investment costs of Sector (B):

- It includes the rest of the Republic according to The laws of incorporation & the distribution of investment activities, for the following investment projects:

- Labor-intensive projects by the controls stipulated in the executive regulations of this law

- Small & Medium Enterprises

- Projects that rely on or produce renewable energy

- National and strategic projects issued by a decision of the Supreme Council for Investment

- Tourism projects issued by a decision of the Supreme Council for Investment

- Electricity production and distribution projects determined by a decision of the Prime Minister based on a joint proposal from the competent minister, the minister concerned with electricity affairs, and the minister of finance

- Projects whose production is exported abroad to the geographical territory of the Arab Republic of Egypt

- The automotive industry, and its feeding industries

- Wood, furniture, printing, packaging, and chemical industries

- Antibiotic, Oncology, and Cosmetics Industries

- Food industries, crops, and recycling of agricultural waste

- Engineering, metallurgy, textile, and leather industries

- Telecommunications and Information Technology-Related Industries

- In all cases, the investment incentive shall not exceed (80%) of the paid-up capital until the date of commencement of the activity, by the provisions of the Income Tax Law promulgated by Law No. 91 of 2005, and the deduction period shall not exceed seven years from the date of commencement of practicing the activity.

Additional incentives:

- Allowing the establishment of special customs ports for the exports or imports of the investment project in agreement with the Minister of Finance

- The state shall bear the value of what the investor guarantees to connect the utilities to the property allocated for the investment project or part thereof after the operation of the project

- The state bears part of the cost of technical training for workers

- all according to The laws of incorporation, Refund half of the value of the land allocated for industrial projects in case of starting production within two years from the date of delivery of the land

- Allocating land free of charge for some strategic activities by the controls prescribed by law in this regard.

How AHG Can Help You

AHG is a member of Morison Global in Egypt, placing us as a top 10 audit firm in Egypt. We have over 30 years of operational experience in incorporation in Dubai and GCC market with a diversified portfolio of clients and industries all according to The laws of incorporation .

AHG-Dubai is approved by the Federal Tax Authority (FTA), as one of the pioneer offices in the UAE. offices are ISO 9001:2015 certified, which employs high-tech software technologies on our audit process to guarantee premium quality assurance.

AHG has years of experience with Dubai Economic Department (DED) License or Free Zone License (all the free zones included)