Egypt and Croatia Sign Double Taxation Avoidance Agreement 2023 To Stimulate Trade and Enhance Investment

Double Taxation…..What Is It?

Double taxation is the imposition of the same tax more than once on the same taxpayer and on the same tax base during the same period. It is not limited to the taxpayer paying the tax twice only, but it may mean paying the same tax more than once, whether it is paid twice or more. It negatively affects international trade and economic growth.

About the Double Taxation Avoidance Agreement

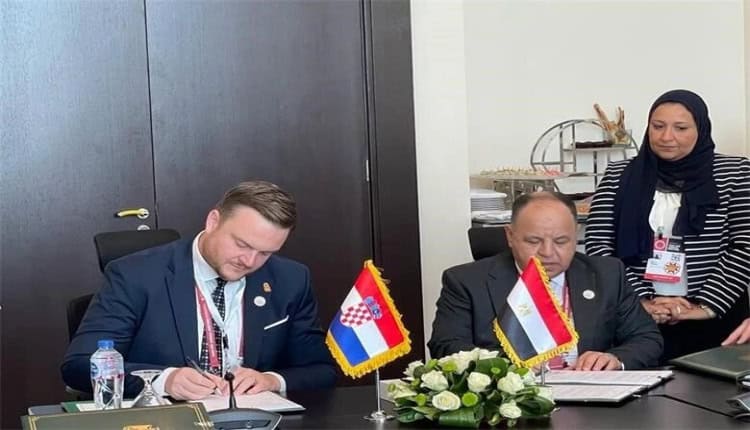

Mohamed Maait, Egypt’s Finance Minister and Governor at the Asian Infrastructure Investment Bank (AIIB), signed double taxation avoidance agreement with his Croatian counterpart Marko Primorac to stimulate trade and enhance investment between the two countries. It is worth noting that Egypt has previously signed a double taxation avoidance agreement with Qatar and Oman.

Let’s not forget to mention that this agreement was signed during their participation in the AIIB’s 8th annual meeting that took place in Sharm El-Sheikh on Sep. 25-26, 2023. This annual meeting has many objectives, including:

The Minister’s Statement during Signing this Agreement

Mr. Mohamed Maait stated that the double taxation agreement signed between Egypt & Croatia reflects the commitment of both countries to enhance economic, trade, and investment relations while safeguarding tax rights, noting that there are proposals to make Croatia a gateway for Egyptian exports to European markets.

He added that Egypt looks forward to increasing Croatian investments in Egypt and leveraging the available development opportunities. It also invites Croatian investors and companies interested in expanding their investments in Egypt to take advantage of the stimulating measures taken by the Egyptian government in various fields, including the Golden License, state ownership policy documents, and government offerings.

He also noted that Egyptian Tax Authority (ETA) continues automating the tax services and harnessing modern electronic systems and artificial intelligence to improve tax performance. This will make the tax system more advanced, attractive, and conducive to local and foreign investment.

It is worth noting that the AIIB’s 8th annual meeting, that took place in Sharm El-Sheikh on Sep. 25-26, 2023, was very fruitful and effective. Many valuable agreements have been signed with other countries, including the signing of a double taxation avoidance agreement between Egypt and Croatia to stimulate trade and enhance investment between the two countries. For more information about this agreement, click here or here.

AHG Chartered Accountants Offers the Best Tax Services

With over 30 years of tax experience, AHG Chartered Accountants provides the best innovative tax advice and services to individuals and businesses. We have professional team familiar with all tax laws and will provide you with the best tax advice.

Our tax agents are specialized in tax laws and can represent individuals or companies before the tax authorities. They can also help clients with tax planning, provide tax guidance, advise on how to reduce taxes and improve compliance with tax requirements, submit tax files and necessary documents to the tax authorities, and participate in negotiations and appeals in case of any tax disputes. In addition, they prepare tax returns and ensure that they comply with current tax legislation. To learn more about our tax consulting and services.