Small business relief UAE corporate tax

What is Small Business Relief?

Small Business Relief is provided to small Businesses resident for Corporate Tax purposes in the UAE to ease their implementation of the Corporate Tax regime. Small Business Relief reduces the compliance obligations faced by small Businesses in the early stages of the Corporate Tax regime, primarily by alleviating the burden of having to calculate and pay Corporate Tax.

Any eligible Taxable Person (being a Resident Taxable Person – either a Natural Person or a Juridical Person) with Revenue below or equal to AED 3,000,0001 in a relevant Tax Period and all previous Tax Periods that end on or before 31 December 20262 can elect to be treated as having no Taxable Income in that period, and will not be obliged to calculate its Taxable Income or complete a full Tax Return.

Who is not eligible for Small Business Relief?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulv

Small Business Relief will be available to UAE Resident Persons whose Revenue does not exceed AED 3,000,000 for the relevant Tax Period and all previous Tax Periods. However, there are two key exceptions to this criterion:

- Where the business is a member of a Multinational Enterprise Group (MNE)

- Where the business is a Qualifying Free Zone Person.

How does Small Business Relief work?

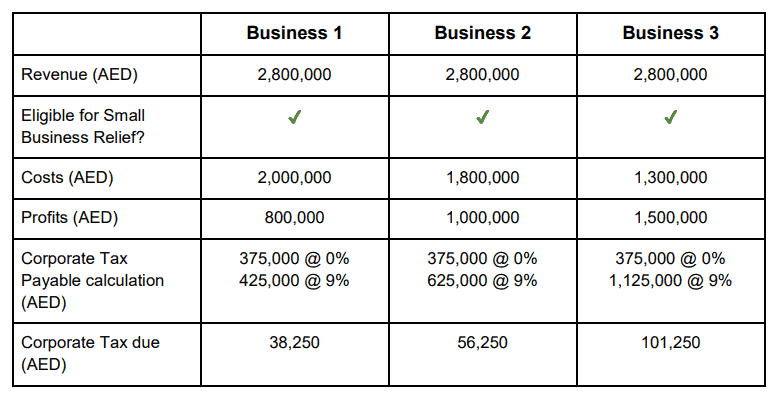

Small Business Relief allows eligible Resident Persons to elect to be treated as having no Taxable Income in a Tax Period where they have Revenue of less than or equal to AED 3,000,000 in a relevant Tax Period and all previous Tax Periods ending on or before 31 December 2026. As a result of this treatment, they will pay no Corporate Tax. The amount of Corporate Tax liability that is not payable based on the relief will depend on the profitability of the Business. This is because Corporate Tax would be paid at the rate of 0% on Taxable Income up to AED 375,000 and 9% on Taxable Income above AED 375,000 had the Small Business Relief not been elected for. This means that the amount of Corporate Tax relief enjoyed by Businesses that are able to elect for Small Business Relief is relative to their profitability, as shown in Table 2 below.

Small Business Relief and relative profitability

Small Business Relief is an optional relief, and Resident Persons that wish to benefit from this advantage must elect for this relief within their Tax Return. Once the Tax Return for the relevant Tax Period has been submitted with no election to benefit from the Small Business Relief, there would be no possibility to claim this benefit at a later stage.

As the election must be made in a Tax Return, an eligible Taxable Person seeking to claim Small Business Relief will first need to register with the FTA for Corporate Tax and obtain a TRN in order to be able to make the election. Additionally, they will need to keep information to demonstrate their eligibility for the relief. This includes keeping records of their Revenue.

Overview of CT and its implications on small businesses in the UAE

Small Business Relief is a game-changer for small businesses operating in the UAE. It allows eligible Resident Taxable Persons, both natural and juridical, to opt for an exemption from UAE Corporate Tax if their revenue meets the criteria. Those who elect for this relief benefit from two significant advantages:

- Administrative Relief: Eligible entities are spared from calculating their Taxable Income, simplifying their tax return filing and record-keeping processes. They can even prepare their Financial Statements using the cash basis of accounting, making financial management more straightforward.

- Tax Relief: Businesses opting for Small Business Relief are not required to pay any Corporate Tax on income earned during the Tax Period.

Here are some additional details about Small Business Relief:

- The reduction is available for tax years beginning after June 1, 2023.

- The revenue threshold of AED 3 million will apply to tax periods that end before or on 31 December 2026.

- A business can elect to claim the Small Business Relief for a particular tax period by filing a notification with the tax authorities.

- The relief can be claimed for multiple consecutive tax periods, as long as the business continues to meet the eligibility criteria.

Ineligibility for Small Business Relief

While Small Business Relief is designed to benefit a broad range of small businesses, there are exceptions:

- Members of Multinational Enterprise Groups (MNEs): Companies that are part of an MNE with a total consolidated group revenue exceeding AED 3.15 billion are not eligible for Small Business Relief.

- Qualifying Free Zone Persons: Qualifying Free Zone Persons already enjoy a 0% Corporate Tax rate on their Qualifying Income and are, therefore, ineligible for Small Business Relief. Qualifying Free Zone Persons must meet specific criteria to maintain their status

How Does Small Business Relief Work?

Small Business Relief treats eligible Resident Persons as having no Taxable Income for the relevant Tax Period if their Revenue falls within the specified threshold. This means they are exempt from paying Corporate Tax during that period. The amount of Corporate Tax relief enjoyed by these businesses depends on their profitability.

The Ministerial Decision on Small Business Relief stipulates the following:

- Taxable persons that are resident persons can claim Small Business Relief where their revenue in the relevant tax period and previous tax periods is below AED3 million for each tax period. This means that once a taxable person exceeds the AED3 million revenue threshold in any tax period, then the Small Business Relief will no longer be available.

- The AED3 million revenue threshold will apply to tax periods starting on or after 1 June 2023 and will only continue to apply to subsequent tax periods that end before or on 31 December 2026.

- Revenue can be determined based on the applicable accounting standards accepted in the UAE.

- Small Business Relief will not be available to Qualifying Free Zone Persons or members of Multinational Enterprises Groups (MNE Groups) as defined in Cabinet Decision No. 44 of 2020 on Organising Reports Submitted by Multinational Companies. MNE Groups are groups of companies with operations in more than one country that have consolidated group revenues of more than AED3.15 billion.

- In tax periods defined in the decision where businesses do not elect to apply for Small Business Relief, they will be able to carry forward any incurred Tax Losses and any disallowed Net Interest Expenditure from such tax periods, for use in future tax periods in which the Small Business Relief is not elected.

- 6. With regard to the artificial separation of business, the Ministerial Decision specifies that where the Federal Tax Authority (FTA) establishes that taxable persons have artificially separated their business or business activity and the total revenue of the entire business or business activity exceeds AED 3 million in any tax period and such persons have elected to apply for Small Business Relief, this would be considered an arrangement to obtain a Corporate Tax advantage under Clause (1) of Article 50 regarding the general anti-abuse rules of the Corporate Tax Law.

UAE announces corporate tax relief for small businesses, startups

The Ministerial Decision No. 73 of 2023 specifies that businesses and individuals with revenues of Dh3 million or less can benefit from the Small Business Relief initiative as it is intended to support start-ups and other small businesses by reducing their corporate tax burden and compliance costs.

The UAE government last year announced that it would levy a nine per cent tax on the profits of companies exceeding Dh375,000.

The Ministry said the Dh3 million revenue threshold will apply to tax periods starting on or after June 1, 2023 and will only continue to apply to subsequent tax periods that end before or on December 31, 2026.

If you’re considering setting up a business in Dubai, you’re not alone. Dubai is one of the fastest-growing business hubs in the world, with a dynamic economy, a strategic location, and a pro-business environment. The city offers a range of opportunities for entrepreneurs, from tech startups to retail businesses, and it has become a popular destination for ambitious entrepreneurs looking to establish their business start up in the Middle East.