Trade License in Dubai

A trade license in Dubai is one of the initial steps toward your dream of owning a business in the most prominent economic hub of the world. The business setup services in Dubai allows various options for Individuals, such as mainland company formation in Dubai, offshore company formation in Dubai, as well as free zone company setup in Dubai.

Before you set up business in Dubai, it is necessary to go through the complete process, starting with trade name registration in Dubai and ending as your company starts functioning.

While setting up a company in Dubai, UAE, you need to have specific permissions for conducting business activities. A trade license in Dubai allows you to conduct most of the activities in the UAE. It is issued by the Department of Economic Development (DED), popularly known as DED Dubai, and thus, can be called a Dubai DED license.

It is also known as a general trade license, and also it supports the following activities:

- For the company formation in Dubai mainland or free zone, this license serves as the gateway of importing and exporting material to and from UAE.

- A license in Dubai will allow you to sell goods as well as services in the various parts of the emirates.

- It is also necessary for professional services such as healthcare and art galleries, etc.

What about Trade License in Dubai?

A Dubai Trade License is one of several licensing options issued to an individual or entity as legal permission to engage in specific commercial activities within the Dubai Emirate. This official document is handed out to business owners by the UAE’s Department of Economic Development (DED) or by the authority bodies of a particular Dubai free zone if that’s where you choose to start your business. Such licenses are essential for establishing and operating a company basically anywhere in the UAE.

As a rule, you need a separate Trade License for a certain type of business activity. However, you can also choose to get a General Trading License, which allows for engaging in several of them at the same time together with a number of other benefits. This will allow you to conduct commercial operations as well as the import/export of commodities.

Types of Trade License in Dubai

There are majorly four trade licenses. However, there are a few exclusive ones only for specific free zones and business activities. The following information will make you familiar with each type now.

Commercial License:

The commercial license in Dubai allows a company to conduct trade activities such as buying as well as selling goods. You can only perform the activities for the items mentioned on the license.

Industrial License:

This license allows the company to manufacture products, import the raw material required for the product, and export the finished product. When you seek an industrial license, make sure you have a physical office in Dubai as it is mandatory.

Professional License:

This license is, particularly for the service providers as well as professionals. The main advantage of this license is you don’t need to have a local sponsor; you can have 100% company ownership.

Tourism License:

As Dubai exclusively values Tourism, it has a separate license for companies engaging in the tourism sector. Therefore, this sector has different rules, regulations, taxes, compliance, and permissions.

Discover where businesses, investors, event organisers and enterprising professionals meet to build an ambitious future together.

Dubai is leading the way in tech, finance and innovation, continuously evolving this future-forward hub for businesses. There are many ways to start or expand your business in Dubai. Find out more with our helpful resources.

Choose the right set-up for your business

The two most common ways of setting up a business in Dubai is either mainland or within one of the Emirate’s 20+ free zones.

Learn more about the benefits of both options and how to get started here:

Mainland:

A Dubai mainland company structure is beneficial to businesses seeking public-private partnerships in the form of taking on government contracts. Companies can also trade internationally in addition to the UAE market.

Free Zone:

There are over 20 free zones in Dubai today. Free zone companies are regulated by the chosen free zone authority, benefit from tax exemptions, and can trade both internationally and within dedicated free zones.

Advantages of Having a Dubai Trade License

Having a Dubai Trade License offers several advantages for businesses seeking to run their operations in the Emirates. Dubai is internationally known for its business-friendly environment courtesy of governmental policies, the Emirate’s logistically outstanding location, and its advanced infrastructure. The combination of these and other factors, including cultural diversity and networking capabilities, make Dubai a very appealing destination lifestyle and business-wise, causing an influx of entrepreneurs and field professionals. Here are some key advantages of having a Dubai Trade License:

- Geographical benefits. Dubai’s geographical location serves as a gateway to both the Middle East and international markets. It provides easy access to markets in Europe, Asia, Africa, and the rest of the Middle East, thus allowing for unparalleled logistical capabilities.

- Tax benefits. In Dubai, there is little to no personal income or corporate tax for most business activities, making it a tax-efficient destination for licensed businesses.

- 100% foreign ownership. Depending on the type of license and the business activity, Dubai offers options for 100% foreign ownership in certain free zones, eliminating the need for a local partner or sponsor.

- All-round flexibility. Dubai offers different types of licenses specific to location, business activities, industries, legal structures, and practices to suit various business needs, allowing companies to choose the most appropriate setup for their operations.

- Credibility factor. This aspect is easy to overlook, but if you’re a foreigner or an expat trying to set up a business in the UAE, a Trade License will be crucial to earning the trust of your future customers, business partners, and government bodies. Not to mention that a valid license will spare you from potential legal problems and other issues with the authorities.

- Access to free zones. Dubai has numerous free zones catering to specific industries, providing businesses with industry-focused environments, reduced regulations, and incentives like customs duty exemptions and full repatriation of profits. In addition, many free zones are based around transportation hubs like seaports and airports, which may be a key factor for certain business activities.

- Skilled workforce. Dubai provides a diverse and skilled labor force, with professionals from around the world contributing to the emirate’s dynamic business environment.

- Setup convenience. In Dubai, the procedural part of business formation takes less time than in other emirates of the UAE, reducing the company set-up period to a few weeks. With the required paperwork prepared in advance, you’ll have your Trade License in no time and without hassle, whether you choose a free zone or mainland.

- No currency restrictions. Dubai allows free movement of capital, enabling businesses to conduct transactions in various world currencies with no restrictions.

- Supportive government initiatives. The Dubai government regularly introduces initiatives and incentives to attract foreign investments and facilitate the work of local businesses. Having a valid Trade License is key to being eligible for such programs and initiatives.

- Opening a business in Dubai often causes company owners to bring their family, relatives, and even employees into the country along with them. With a Trade License, you can take care of your dependents by legally sponsoring them and helping them obtain residency visas.

- Financing and investment capabilities. Dubai has a well-developed banking and financial sector, providing access to various financing options for businesses, including loans and investment opportunities.

Required Documents

In order to apply for a Trade License in Dubai, you must prepare the necessary paperwork, which usually includes:

- Residency visa copies

- Passport copies of partners or shareholders

- Emirate IDs

- Trade name reservation certificate

- No Objection Certificate (NOC) from the local sponsor or partner (if applicable)

- Memorandum of Association (MOA) for LLC structures

- Lease agreement for the office space

- Any additional documents requested by the DED

How Do I Get a Trade License?

Here are the key steps to obtain a Trade License in Dubai.

- First, decide on the specific business activities you intend to conduct under your Trade License, as the license type will depend on the nature of your business.

- Choose the legal entity for your business, such as a sole proprietorship, LLC, partnership, or company branch. The legal structure you select will affect your company’s liability, ownership, and other aspects.

- Select a unique and appropriate name for your business. Ensure that the proposed name complies with naming conventions and does not infringe on any existing trademarks.

- Depending on your business structure and activities, you may need a local sponsor or partner who is a UAE national or a UAE-based company. The local sponsor’s involvement and share in the business will vary based on the structure.

- Secure a physical office or commercial space for your business that meets the requirements set by the DED, as you will need to provide a lease agreement during the licensing process.

- Prepare the paperwork necessary for the application.

- Complete the license application form and submit it to the DED. Ensure that all required documents are attached to the application.

- Pay the relevant charges, trade name registration fees, and any other government or regulatory fees as required.

- Your application and documents will be assessed by the DED. This process may take some time, and you may be asked for additional information or clarification.

- Once your application is approved, the DED will issue your Trade License.

- If you plan to obtain residency visas for yourself, employees, or partners, you can initiate the visa application process, which includes medical examinations and other requirements.

- After obtaining the Trade License, ensure that your business operations comply with the DED regulations. Trade licenses typically need to be renewed annually.

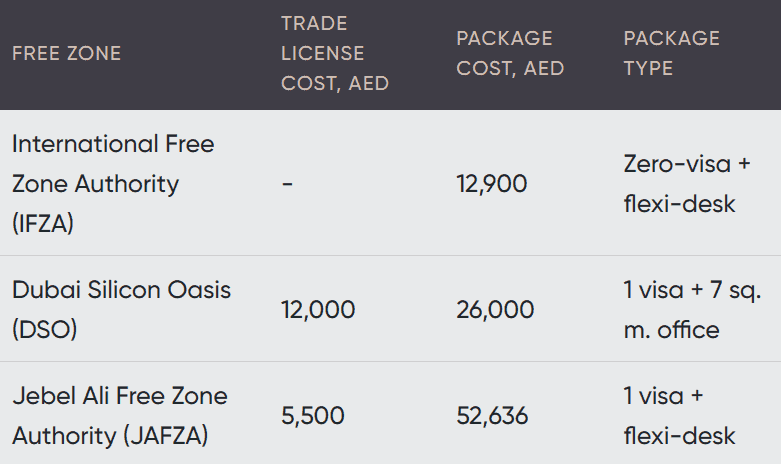

Dubai Trade License Costs

In Dubai, a Trade License can cost from AED 15,000 to 50,000 based on a number of factors, such as:

- Company location (particular free zone or mainland region)

- Company structure (sole proprietorship, LLC, Free Zone Establishment (FZE), offshore company, etc.)

- Business activity (different commodity types require different permits)

- Number of partners or shareholders

- Staff size (visa costs, medical checkups, etc.)

- Partnerships with local sponsors

There are additional fees related to acquiring and renewing a Trade License that are typically tied to the company setup procedure and may vary accordingly, which is why it’s important to check with the relevant authorities for up-to-date information. Such fees may include:

- Trade name reservation fee

- License application fee

- License issuance fee

- Commercial activity fees

- Local sponsorship fee (if applicable)

- Office space rent

- Renewal fees

- Visa fees (if applicable)

- Additional fees (safety inspections, environmental permits, and other regulatory compliance requirements)

- Third-party fees (legal advice, notary charges, etc.)

Dubai Trade License Renewal

Renewing a Dubai Trade License is a standard procedure that businesses must follow to maintain their legal status and continue their operations in Dubai. It’s essential to renew your Trade License in a timely manner to avoid penalties or disruptions to your business. Here are the general steps to renew a Trade License in Dubai.

Review the expiry date. Check the renewal date to ensure you have ample time to complete the renewal process. Trade licenses in Dubai typically need to be renewed annually.

Clear any outstanding fees. Before initiating the renewal process, make sure there are no outstanding fines, fees, or payments associated with your Trade License. Outstanding payments can delay the renewal.

Gather the required documents. Prepare the necessary documentation for the renewal process, which may include the following:

- Trade name reservation fee

- Current trade license copy

- Passport copies of partners or shareholders

- Passport copy of the manager or legal representative

- Valid tenancy contract for your business premises

- Rental contract registration certificate

- Receipts for payment of renewal fees.

Dubai provides entrepreneurs and company owners with different Trade License types depending on their needs and means. Given the offered variety, you can always find an option ideal for your business. A Dubai Trade License comes with numerous advantages for business owners and is key to securing a legal position in the UAE market with access to all the opportunities this country can provide.

Our company AHG can help you establish your company or investment, by providing integrated and specialized services, which ensure the success of the project and the achievement of its goals. Therefore, contacting us is an essential step to achieving success in business.