TRN number in UAE

What is a Tax Registration Number (TRN)?

TRN is the identification number given to every person registered under UAE VAT

Importance of TRN

Under UAE VAT laws, the taxable person with TRN can only charge VAT on invoices. Accordingly, they must mention the valid TRN on all invoices. Further, the 15-digit TRN separates the registered and unregistered businesses.

UAE VAT Law mandates businesses to quote TRN on all tax-related documents, such as:

- Tax invoice

- Credit notes

- VAT returns

- Other documents specified under UAE VAT

Step-by-step process to verify TRN

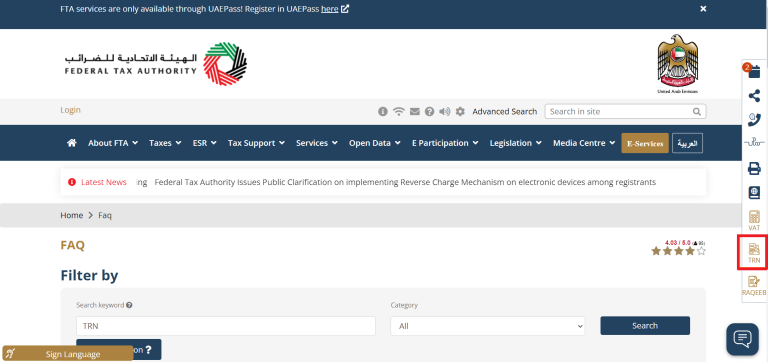

Anyone can verify TRN on the FTA portal. Below is the step-by-step process to verify TRN:

Step 1: Visit https://tax.gov.ae/en/default.aspx and click the ‘TRN’ icon on the right-side panel.

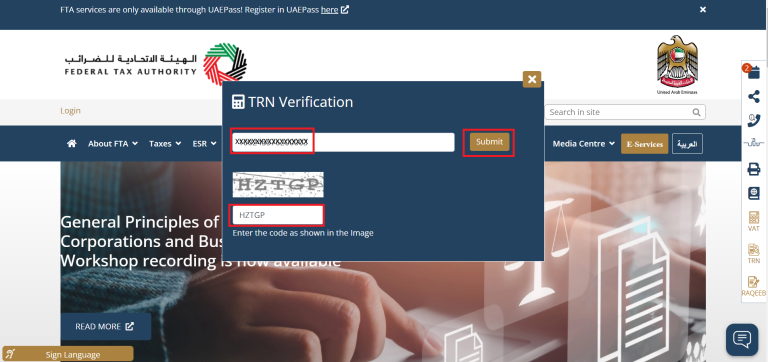

Step 2: Enter the TRN and Captcha code in the boxes provided. Now, click on the ‘Search’ button.

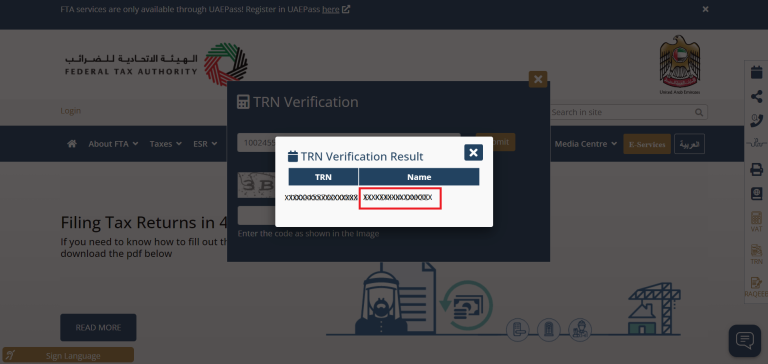

Step 3: You can see the business’s name linked to the TRN and check the same with your record.

How many digits does a TRN Number contain?

TRN Number is a 15-digit number issued by the Federal Tax Authority, UAE.

What happens if I don’t verify the TRN while paying an Invoice?

The input tax paid on purchase can go to the wrong hands, and you may be unable to claim the Input Tax Credit (ITC). Hence, it is always advisable to do VAT Verification.

Required Documents

To register for VAT, you need to scan some documents and upload them to FTA. The registration process is an online process and does not require any physical presence or physical presentation of any documents. The following lists the most common documents that need to be prepared during the registration process.

- A copy of the business license of the company,

- A copy of the passport of the partner or business owner,

- ID issued by the UAE government,

- Contact information of the owner, the company’s address (including post office box) and contact information,

- Company’s organization memo,

- Bank details

- Income statement for the past year.

These documents are required to register for VAT. The number of documents regarding the nature of the business may vary.

Role of TRN Number of Company

TRN number plays a huge role in processing different Tax-related documents and permits companies to avail multiple tac advantages and claim different tax advantages. Since the value-added tax (VAT) is a comparatively new tax that is being levied in the nation, VAT adherence is most crucial for a company.

TRN helps businesses to communicate easily with the clients, suppliers, and vendors in invoices processing which would need the TRN to be mentioned on all documents that are related to tax. This method of enhancing the processing of TRN and invoice would certainly help companies to claim tax credit advantages for the taxes paid.

Since a TRN number UAE is the initial step to moving in the correct direction of VAT and adherence is most crucial in VAT implementation, even provision-based TRN, a preliminary phase, is the very crucial step. The FTA (Federal Tax Authority) stated that it had issued already a provisional TRN for tax groups and this would soon provide similar individual businesses.

HOW LONG DOES IT TAKE TO GET TRN NUMBER?

No matter what industry you’re in, the business transaction needs TRN number.

Your submitted VAT registration form and document are reviewed.

It takes 21 working days after the approval of your information to get a TRN

AHG, Top Audit and Chartered Accountants firm in UAE. Corporate Tax is to be withheld from State Sourced Income of UAE businesses in accordance with Article 45 of this Decree-Law