The UAE Tax Authority has assessed its advancement in implementing the novel corporate tax system in 2023. As per the UAE Tax Authority, it is making progress as planned, with more than 100,000 corporations having enrolled for the new tax system to date. Furthermore, the UAE Tax Authority has stated its efforts to ensure the impartiality and justness of the new tax system for all enterprises.

UAE Tax Authority

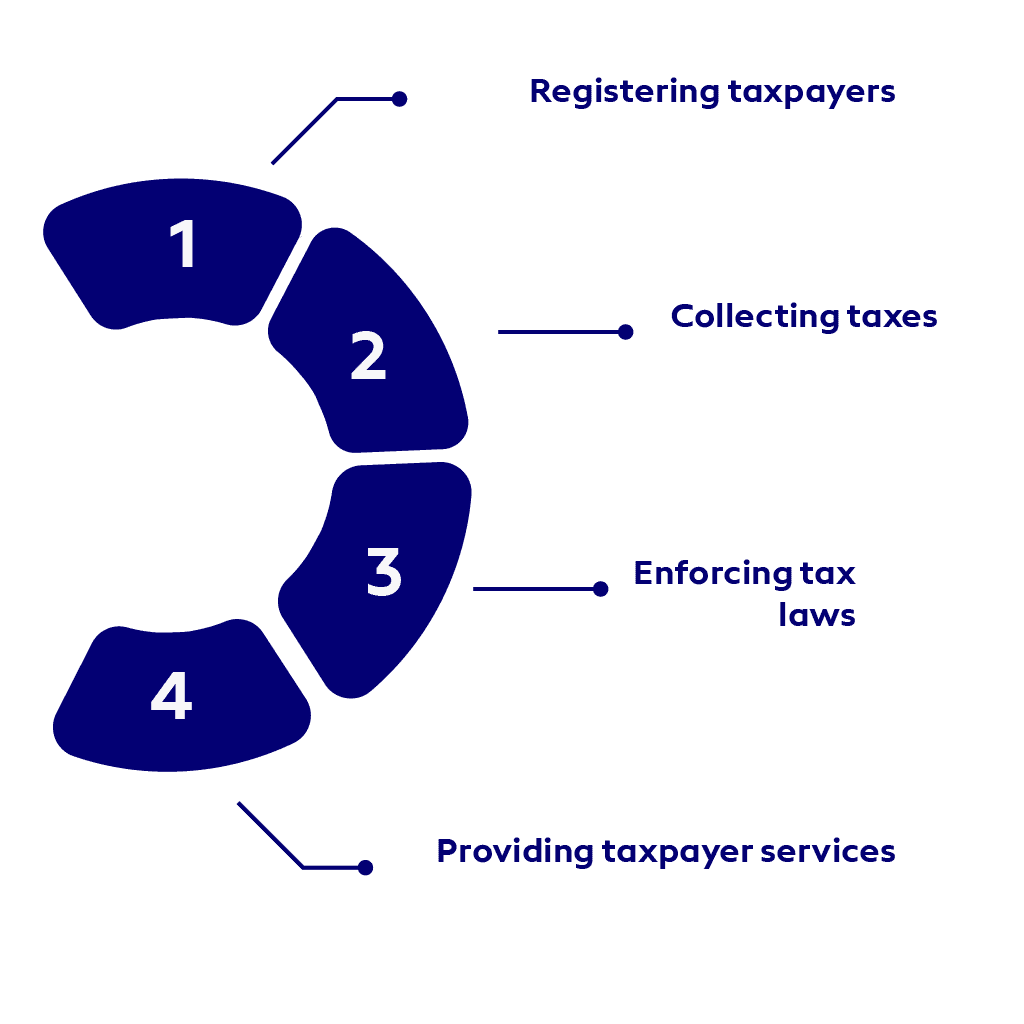

The UAE Tax Authority is the government body accountable for implementing the tax regulations in the UAE. Established in 2017 and based in Abu Dhabi, the UAE Tax Authority carries out several duties, including:

- Registering taxpayers

- Collecting taxes

- Enforcing tax laws

- Providing taxpayer services

UAE Corporate Tax

The UAE Tax Authority has launched a novel corporate tax system in 2023, applicable to all enterprises generating taxable income above AED 375,000 and featuring a primary rate of 9%. This new regime is anticipated to generate AED 20 billion in supplementary revenue for the UAE government.

UAE Corporate Tax Regime

The UAE Tax Authority implements a corporate tax system founded on the territoriality principle. As such, enterprises are solely taxed on their income originating from within the UAE. Companies resident in the UAE but earning all their income from outside the country are exempt from corporate tax.

Moreover, the UAE Tax Authority’s corporate tax regime is relatively uncomplicated, mandating businesses to file their tax returns annually and pay taxes on their taxable income. The taxable income is determined by deducting the authorized expenses from the gross income.

UAE Tax Registration

All businesses that are subject to the UAE’s corporate tax regime are required to register with the FTA. Businesses can register online or by submitting a paper application to the FTA.

UAE Tax Compliance

Businesses that are subject to the UAE’s corporate tax regime are required to comply with a number of tax laws and regulations. These laws and regulations include:

- The Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses

- The FTA’s executive regulations

- The FTA’s guidance notes

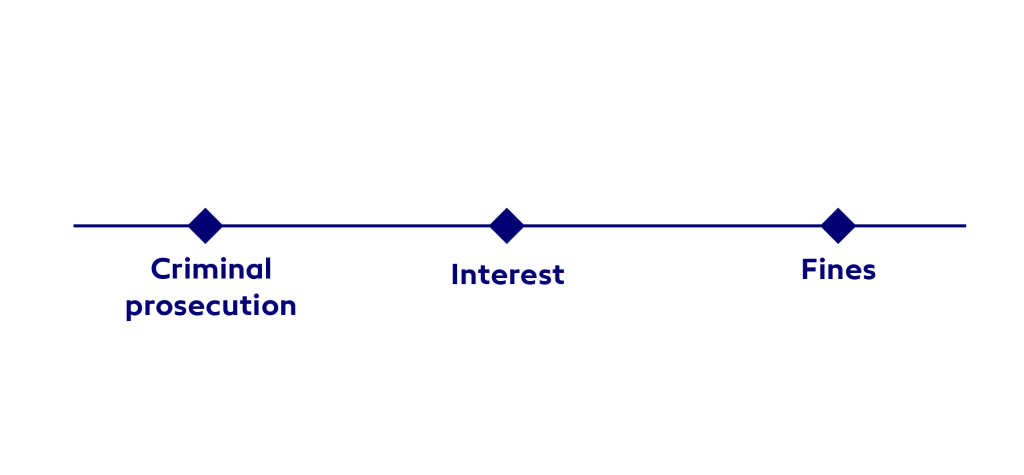

Businesses that fail to comply with the UAE’s tax laws and regulations may be subject to a number of penalties, including:

- Fines

- Interest

- Criminal prosecution

UAE Tax Fairness

The UAE’s corporate tax regime is designed to be fair and equitable for all businesses. The regime is based on the principle of neutrality, which means that businesses are not discriminated against on the basis of their size, industry, or location.

The UAE’s corporate tax regime is also transparent. The FTA publishes all of its tax laws and regulations on its website. Businesses can also contact the FTA for assistance in understanding the tax laws and regulations.

UAE Tax Equity

The UAE’s corporate tax regime is designed to be equitable for all businesses. The regime ensures that all businesses pay their fair share of taxes. The regime also provides a number of tax deductions and exemptions to help businesses reduce their tax liability.

UAE Economic News

The UAE Tax Authority’s launch of a new corporate tax system is a beneficial progress for the nation’s economy. The novel regime is predicted to generate supplementary revenue of AED 20 billion for the UAE government, which could be utilized to finance government initiatives and infrastructure schemes.

Moreover, the new system is anticipated to increase the UAE’s appeal as a business destination. Companies are more prone to invest in countries where they are subjected to a just and reasonable share of taxes.

UAE Business News

The UAE Tax Authority’s launch of a new corporate tax system is a crucial milestone for enterprises functioning in the country. Businesses are required to be well-informed about the new regime and its impact on their activities. Moreover, it is advisable for businesses to consult with a tax advisor to guarantee their compliance with the new regime, as regulated by the UAE Tax Authority .

UAE Finance News

The introduction of a new corporate tax regime in the UAE is a positive development for the country’s finance sector. The new regime is expected to raise an additional AED 20 billion in revenue for the UAE government. This revenue can be used to fund government programs and infrastructure projects.

The new regime is also expected to make the UAE a more attractive destination for businesses. Businesses are more likely to invest in a country where they have to pay a fair share of taxes.

AHG is a leading regional auditing and legal accounting firm present in the Gulf Cooperation Council and North Africa. Since 2014, AHG has helped businesses operating in the United Arab Emirates achieve maximum success. We are fully prepared to assist your business in the UAE through a team of trained tax experts to prepare your business for corporate tax in the UAE.

AHG-Dubai serves a wide range of multinational clients and companies. This comes in light of the company’s strategy to focus on two core pillars: geographical expansion in border markets and leading a positive community culture. By combining our strengths and experiences in the region, we provide our clients with the best services in their category designed to maximize their investment goals in a fast-changing environment