VAT fines services in Dubai

VAT fines and Penalties in Dubai

According to the UAE Federal Tax Authority, severe penalties will be imposed on businesses or individuals in case of non-compliance with VAT Law or any violation of executive regulation. Thus, it is crucial for all the taxpayers to be well aware of all the situations that can lead to the imposition of VAT fines in Dubai, UAE. Every company in UAE is well known for VAT registration and VAT return filing process and also the respective changes that must be made in routine business operations to incorporate tax.

Kinds of VAT Fines and Penalties in Dubai

Given below is the summary of different kinds of penalties and VAT fines applicable in case of VAT law violation or VAT law non-compliance in UAE:

- VAT Fines related to VAT Registration in UAE: When a taxable person fails to register for VAT within the specified timeline which is in 30 days from reaching the turnover limit, then a penalty of AED 20,000 shall be applicable.

- VAT Fines in case of Failure to Maintain the Records: If any taxable person conducting business in the UAE fails to keep the required records or any such information will be fined AED 10,000 for the first time and AED 50,000 in case of repetition.

- VAT Fines in case of Failure to Submit Records in Arabic: If any taxable person fails to submit any records or data or any other supporting documents when requested by the authority in Arabic AED 20,000 penalty will be imposed.

- VAT Fines related to VAT Deregistration in UAE: A penalty of AED 10,000 shall be applicable to a business failing to deregister within the time specified by the authority, that is 20 business days from the closure.

- VAT Fines in case of Failure to Display Prices Inclusive of VAT: The displayed price of the product should be the maximum price that the customer will have to pay while receiving the tax invoice. A VAT penalty of AED 15,000 would be levied in Dubai, Abu Dhabi, UAE if the taxable person fails to display prices inclusive of VAT.

- VAT Fines in case of Failure to Issue a Tax Invoice and Tax Credit Note: If the taxable person fails to issue a tax invoice or tax credit note, then they would be penalized with AED 5000 for each tax invoice or tax credit note.

- VAT Fines in case of Delay in Filing the VAT Return in Dubai, UAE: If a taxable person fails to submit the VAT Returns before the 28thof the month following the tax period, then AED 1,000 will be charged as a penalty for the first time, and if it is repeated than AED 2,000 would be levied.

THE FTA – overseeing VAT in the UAE

The Federal Tax Authority (FTA) was established under Federal Law by Decree No. 13 of 2016. The authority takes charge of managing and collecting federal taxes and related fines, as well as distributing tax-generated revenues and applying the tax-related procedures in the UAE.

The authority’s Chairman is His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, Minister of Finance, while His Excellency Khalid Al Bustani takes up the position of Director General directly from his role as the Assistant Undersecretary of International Financial Affairs at MoF – a role he held for more than 37 years. FTA will work alongside MoF in its drive to achieve economic diversification in the UAE, with a focus on profits derived from non-oil sources. It will work towards enhancing the financial stability of the UAE, and will provide guidance and assistance to businesses and consumers to ensure they meet their liabilities and understand fully the application of taxation in the country.

What is Value Added Tax (VAT)?

Value Added Tax (or VAT) is an indirect tax. Occasionally, it might be referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and services that are bought and sold.

VAT is one of the most common types of consumption tax found around the world. Over 150 countries have implemented VAT (or its equivalent, Goods and Services Tax), including all 29 European Union (EU) members, Canada, New Zealand, Australia, Singapore and Malaysia.

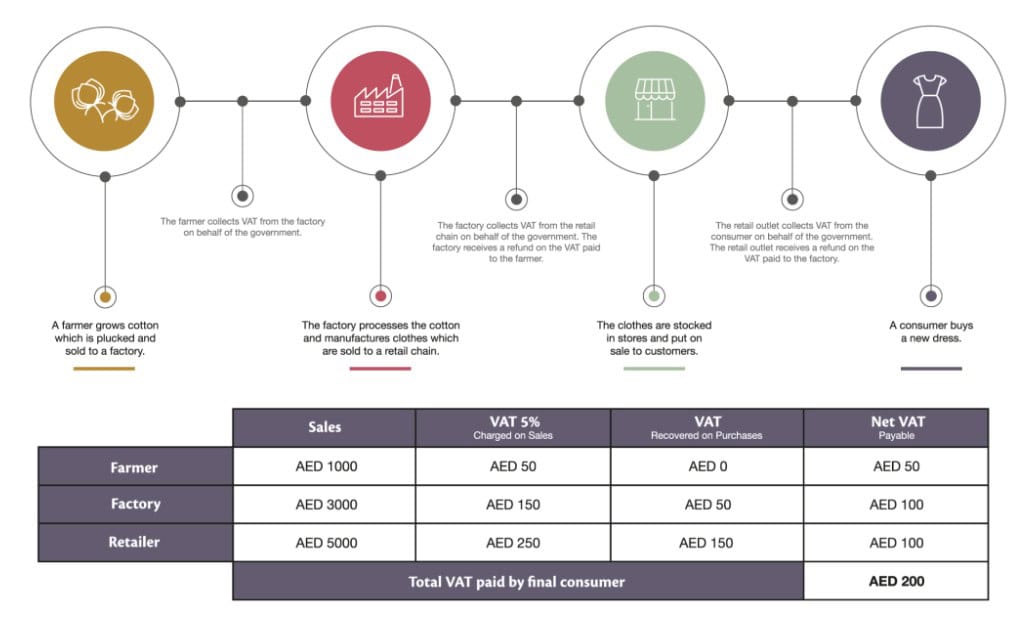

VAT is charged at each step of the “supply chain”. Ultimate consumers generally bear the VAT cost while businesses collect and account for the tax, in a way acting as a tax collector on behalf of the government.

A business pays the government the tax that it collects from the customers while it may also receive a refund from the government on tax that it has paid to its suppliers. The net result is that tax receipts to the government reflect the “value add” throughout the supply chain. Below is a simple, illustrative example explaining how VAT works (based on a VAT rate of 5%)

The difference between VAT and Sales Tax

A sales tax is also a consumption tax, just like VAT. For the general public there may be no observable difference between how the two types of taxes work, but there are some key differences. In many countries, sales taxes are only imposed on transactions involving goods. In addition, sales tax is only imposed on the final sale to the consumer. This contrasts with VAT which is imposed on goods and services and is charged throughout the supply chain, including on the final sale. VAT is also imposed on imports of goods and services so as to ensure that a level playing field is maintained for domestic providers of those same goods and services.

Many countries prefer VAT over sales taxes for a range of reasons. Importantly, VAT is considered to be a more sophisticated approach to taxation as it makes businesses serve as tax collectors on behalf of the government and cuts down on misreporting and tax evasion.

How to Calculate VAT in UAE?

On most of the products, 5% VAT is implemented. However, there are few products on which 0% VAT is implemented, and a few products are exempted from VAT. Therefore, while using VAT calculator UAE, it is important to add the correct VAT percentage.

For the products which are exempted or have 0% VAT, you don’t need to use the UAE VAT calculator as the VAT amount is Zero. However, one must use our online VAT calculator in Dubai when 5% VAT is applicable to goods and services.