VAT refund in UAE for tourists

Tourists and visitors can claim refund on VAT paid on purchases they made during their stay in the UAE. Recovery of payment will be done through a fully integrated electronic system which connects retailers registered in the ‘Tax Refund for Tourists Scheme’ with all ports of entry and exit from the UAE.

Understanding VAT in UAE

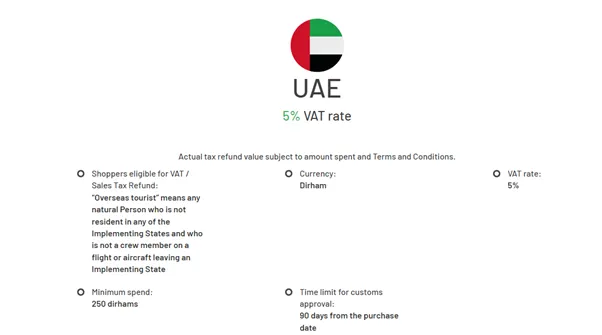

VAT, or Value Added Tax, is a form of indirect tax applied in more than 160 countries worldwide. In the UAE, it is applied at the standard rate of 5% on most goods and services, excluding specific essential items like healthcare and education. This means that when you shop in the UAE, most of your purchases will have a 5% VAT added to the price.

What is tax-free shopping?

Tax-free shopping is the purchasing of taxable goods in the UAE which will be exported, subject to terms and conditions. Eligible tourists may request a refund on the VAT incurred on their purchases, after they validate their purchases at the point of exit. Refunds for already export validated tags can be claimed within one year from the date of export validation.

Conditions for tourists to claim their VAT refunds

Refunds are not applicable on:

- anything that has been consumed, fully or partly in the UAE, and

- goods that are not in the possession of the tourist when leaving the country.

Other conditions to claim refund include:

- The tourist must be at least 18 years old

- Goods must be purchased from a retailer who is participating in the ‘Tax Refund for Tourists’ scheme

- Goods are not excluded from the refund scheme of the FTA

- The tourist must physically present the tax invoice, ‘tax-free’ tags and relevant goods.

How to collect VAT refund in UAE?

Tourists can collect their refunds through a special device placed at the departure port – airport, seaport or border port. They must submit:

- the tax invoices for their purchases from the outlets registered in the scheme

- a copy of their passport and

- a copy of their credit card.

After they submit these documents, tourists can recover the VAT either in cash in UAE dirhams, or have it refunded to their credit card.

Tourists can use this eService from FTA, in cooperation with Planet, to have their VAT reimbursed upon their departure from the UAE.

Note: The tourist will receive 85 per cent of the total VAT amount paid, after the deduction of a fee of AED 4.80 per tax-free tag.

What information will you need when completing the Refund Form?

During the Refund claim process, you will be asked for various documents as listed below. It is advisable that you have these to hand prior to starting your application:

- Original Tax Compliance Certificate (such as business status certificate, certificate of commercial activities or equivalent) in Arabic or English issued by the relevant competent Tax Administration reflecting your tax registration number (“TRN”) attested by UAE Embassy in country of tax registration.

- If you are undertaking exempt or non-business activities in your country of establishment, which do not give you the right to fully recover any input tax, you will need to provide a declaration in Arabic or English indicating the level (percentage) of input tax you are eligible to recover on expenses.

- The relevant tax invoices with valid tax registration number and proof of payment to support your refund claim. Note that an invalid tax invoice will be rejected (e.g. having an incorrect TRN).

- Copy of passport of the Authorised Signatory

- Proof of Authority of the Authorised Signatory

When will you get the VAT refund?

Usually, FTA will review the VAT refund application, process and notify you within 20 days from the application submission date. The authority either accepts or rejects the VAT refund claim. The authority will credit the refund within five business days once your claim is approved.

However, FTA may take more than 20 days to process the VAT refund application and notify you accordingly.

VAT refund in UAE for tourists

FTA implemented the ‘Electronic Tax Refund Scheme for Tourists’ to allow UAE tourists to claim refunds of VAT paid on their purchases.

However, the seller must satisfy the below conditions so that the tourists can claim the VAT refund:

- The seller/ retailer must be registered under UAE VAT and have a Tax Registration Number (TRN)

- The goods must not be excluded from the refund scheme mentioned by the authority.

- The retailer/seller must submit a request to participate in the scheme.

- The retailer must meet the requirements specified and regularly submit tax returns and pay due taxes.

AHG as registered Tax agents in Dubai provides creative tax consulting services to a broad range of individuals and businesses. Our strong technical understanding of the tax laws is backed by a solid understanding of your business dynamics, with more than 30+ years of Practical Experiences, Dealing thousands of times with Tax Inspectors & our Multilingual team we can give you the best tax advice